Table of Contents

So you got a letter. It has a big, friendly-sounding insurance company logo at the top—Allstate, Geico, Progressive, you name it. And inside is a check. It’s the first offer for your injury claim.

Maybe you breathe a sigh of relief. Finally. Something to help with the bills piling up while you’ve been out of work, in pain, trying to put your life back together.

And that feeling—that exact sigh of relief—is the most dangerous moment in your entire case. It’s what they’re counting on. Because that first offer isn’t a good-faith attempt to make you whole. It’s a test. It’s a probe, sent out from their corporate Death Star to see if you’re desperate enough / tired enough / uninformed enough to take the bait. This is how you learn how to negotiate with an insurance adjuster—you have to understand that their first move is always a trap.

The First Offer Is a Punch You’re Supposed to See Coming

That first settlement offer from the insurance adjuster isn't a mistake. It’s a tactic.

Want a quick estimate?

Use our free settlement calculator to see what your case might be worth in 60 seconds—no email required.

It’s a carefully calculated, intentionally insulting figure designed to find out what you're made of. It’s business. Your fair compensation is a line item on their spreadsheet—an expense to be minimized.

The psychology here is as simple as it is predatory. It’s a move called “anchoring.” By starting with a laughably low number, the adjuster frames the entire negotiation around their pathetic figure—not yours.

Suddenly, getting them to double that number feels like a victory—even if it’s still only 20% of what your claim is actually worth. How you react in this moment sets the tone for everything that follows.

The Trick Insurance Companies Don’t Want You to Know: Preparation Is Power

Winning this fight doesn’t happen on the phone. It’s won at your kitchen table, with a scanner and a stack of paper. The single most powerful tool you have when you negotiate with an insurance adjuster is a meticulously organized case file.

Your mission is to build a fortress of facts so tall the adjuster can’t see over it.

Here’s your essential checklist—your absolute non-negotiables:

- The Police Report: The objective, third-party foundation. It establishes the facts.

- Every Single Medical Bill: From the ambulance to the last physical therapy co-pay. Every receipt is a brick in your wall.

- Complete Medical Records: This is the story of your injury, written by doctors. It directly connects the crash to your harm.

- Proof of Lost Wages: A letter from your employer on company letterhead stating your pay rate and the exact dates you couldn’t work.

- Property Damage Estimates: Multiple quotes to repair/replace your car and anything else that was destroyed.

This stuff—the black-and-white numbers—is just the beginning. The real fight is over what they can’t see. Your pain. Your sleepless nights. Your frustration.

And their favorite tactic? They will delay, delay, delay, hoping you forget the daily misery.

You fight back with a pain journal. It’s your secret weapon. It translates your suffering into evidence. Every day, you write down your pain levels (1-10), what you couldn't do, and how it made you feel. It gives a voice to the silent part of your injury—and it's incredibly difficult for them to argue against your own lived experience.

How to Calculate What Your Claim Is Actually Worth

This is the part they pray you never figure out. They want you to think your claim is just a stack of bills.

They are dead wrong.

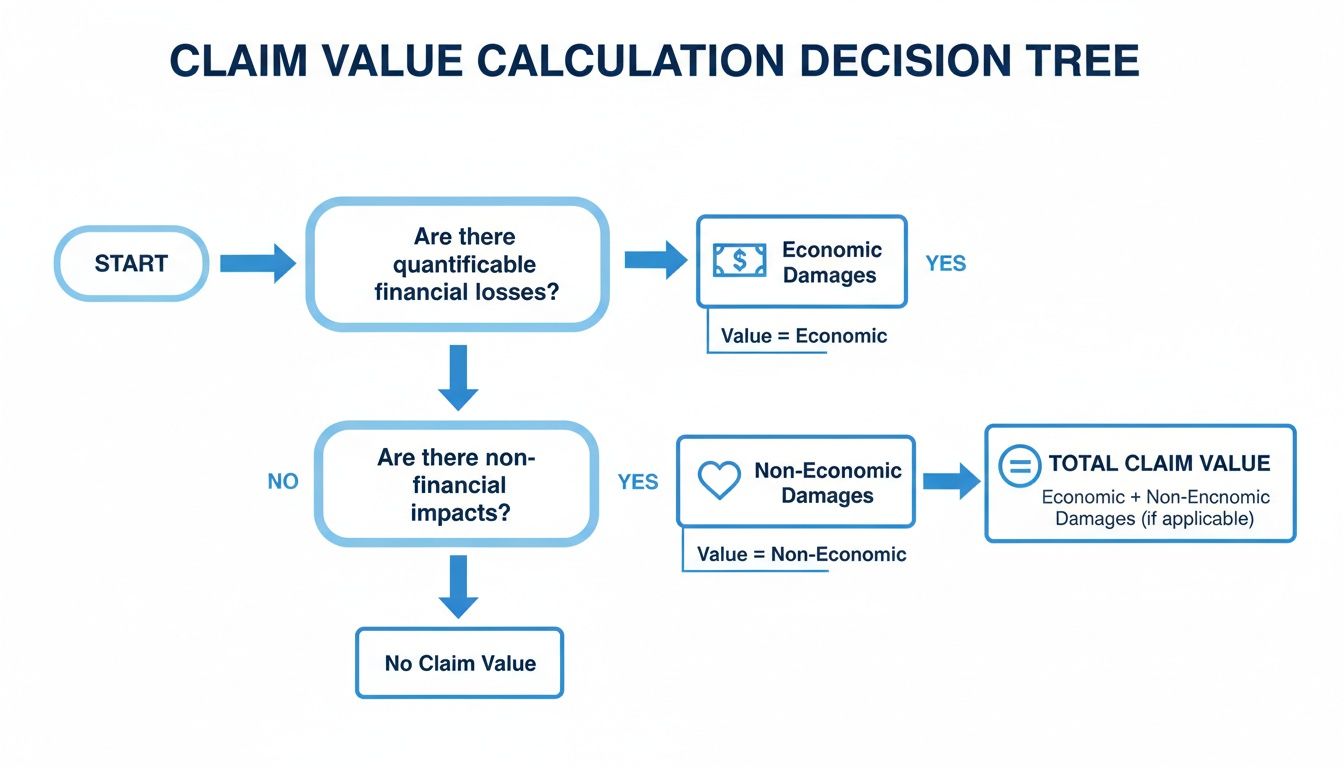

Your claim has two parts: Economic Damages (the easy math) and Non-Economic Damages (the human cost).

Economic Damages: The Black and White

This is the sum total of every dollar the crash has cost you out of pocket.

- Medical Expenses: Past, present, and future. All of it.

- Lost Income: Wages you lost and wages you will lose if your ability to work is permanently impacted.

- Property Damage: The cost to fix or replace your stuff.

This total is your floor. Your absolute baseline. An offer that doesn’t cover this isn't just low—it's an insult.

Non-Economic Damages: The Human Cost

This is your pain and suffering. The anxiety. The loss of enjoyment of life—not being able to hike, play with your kids, or just get through a day without hurting.

Adjusters use a cynical shortcut called the "multiplier method." They take your medical bills and multiply them by a number between 1.5 and 5. A minor sprain might get a 1.5x. A permanent, life-altering injury could get a 5x or more. This isn't law—it's just their starting point for devaluing you. You can learn more about how to calculate pain and suffering damages to get this right.

Your job is to use your evidence—your pain journal, your doctor’s reports—to justify the highest possible multiplier. Don’t let them define your suffering. You define it.

The lesson is always the same: document everything, know the real value, and never let them set the terms.

And in Colorado, remember this: if you are found 50% or more at fault, you get nothing. Zero. Adjusters use this rule—modified comparative fault—to attack your final number, which is why you never, ever admit any fault.

This Is How You Win the Conversation

You’ve done the work. Now it’s time to talk. This is a game of control, and you’re going to own the narrative from the first word.

One of the first things the at-fault party's adjuster will ask for is a recorded statement. They’ll say it’s routine.

It’s a trap. It is always a trap. You have no legal obligation to give one.

Here’s your script. Memorize it.

"Thank you, but I won't be providing a recorded statement. I am happy to provide all necessary information in writing."

That's it. Polite. Firm. End of discussion. This shuts down their most common ambush tactic right out of the gate.

Then, you prepare for their other favorite plays:

- The "Pre-Existing Injury" Ploy: They'll blame your pain on an old injury. Your response: "My doctor's records clearly state this injury was directly caused by this accident."

- The "80% Liability" Shuffle: They'll try to pin 20% of the fault on you to slash your settlement. Your response: "The police report shows your insured was 100% at fault. I do not accept any liability."

- The Delay Game: Their best weapon. They go silent, hoping you’ll get desperate. Your response: You create a paper trail. Send a follow-up email after every call, summarizing what was said and setting a deadline for their response.

Patience is your superpower. Persistence pays off. It's not uncommon for a serious claim with a $10,000 first offer to eventually settle for $100,000 or more. Why? Because the claimant refused to fold.

And yes, their most common tactic is the delay game. They want to starve you out. Don't let them. Every day they spend on your well-documented file is a loss for them. You are in control.

Know When to Call in the Cavalry

You can do everything right—and still hit a wall.

Sometimes, the adjuster simply refuses to be reasonable. This isn’t a sign your claim is weak. It’s a sign you’ve pushed their cynical process as far as one person can. It's time to escalate.

Here are the red flags—the signals that the negotiation is over:

- They Flat-Out Deny Liability: Despite clear evidence, they blame you.

- They Won’t Budge from a Pathetic Offer: They're not negotiating in good faith.

- Your Injuries are Serious or Long-Term: The stakes are too high to go it alone.

- They Start Blaming You: They're trying to use Colorado's fault rules to cheat you.

Hiring a personal injury lawyer isn’t throwing in the towel. It’s bringing a special forces operator into a knife fight. It sends a message: the days of easy denials are over.

The stats are shocking: over 50% of insurance claim appeals succeed, yet only 1% of people even file one. Don't be in the 99% who give up. If your claim is denied, you immediately read our guide on how to appeal a denied insurance claim in Colorado.

Final Briefing: Your Last-Minute Questions

Let’s clear the air on the final curveballs adjusters love to throw.

"Why can't I just give a recorded statement?"

Because it's a trap. Period. Their only goal is to get you to say something—anything—they can twist to deny your claim. Politely refuse.

"How long does this take?"

Longer than you want it to. And that's by design. A simple case might take a few months. A complex one can take over a year. Their most potent weapon is delay.

"What if the adjuster just stops responding?"

It’s called “ghosting,” and it’s their final, desperate bet that you’ll give up. You prove them wrong. Send a final demand letter via certified mail with a 10-day deadline. When they miss it—and they will—it's time to call a lawyer. You gave them every chance. Now, you escalate.

This process is a battle of wills. If you’ve hit a wall or just want a professional to take over the fight, my team at Conduit Law is here. I’ve got you.

Call us for a free, no-obligation case evaluation. We’ll tell you exactly where you stand and how we can help. https://conduit.law

Disclaimer: This blog post is for informational purposes only and does not constitute legal advice. Reading this post does not create an attorney-client relationship. Every case is unique, and you should consult with a qualified attorney to discuss the specifics of your situation.

Written by

Conduit Law

Personal injury attorney at Conduit Law, dedicated to helping Colorado accident victims get the compensation they deserve.

Learn more about our team