Table of Contents

Let me tell you about a guy who walked into my office a few months back. He’d just been through a nightmare on I-25 — a multi-car pileup caused by a distracted driver. He did everything “right.” Paid his insurance on time, kept the little card in his glovebox, and trusted his agent who said he was “fully covered.”

Then the hospital bills landed. It wasn’t a trickle; it was a tidal wave. He discovered — in the worst way possible — that the other driver’s flimsy, state-minimum policy was a joke. A cruel joke. He also discovered his own policy wasn’t much better.

He’d been sold a financial trap, meticulously designed to protect an insurance company’s profits, not his family’s future.

This isn’t just a guide to the legal-minimum auto insurance requirements in Colorado. This is the crowbar we’re going to use to pry that trap open. We’re pulling back the curtain to show you how to build a real financial shield — a shield against the chaos of the road and the cold, calculated greed of an industry that profits from your confusion. Forget just checking a box to be legal. It's time to get protected.

The Minimum Is A Trap And Insurers Set It

“Minimum coverage” feels safe, doesn’t it? It has a nice, sturdy ring to it. A baseline. A foundation. The insurance industry loves this phrase — adores it — because it coaxes you into believing that buying the cheapest legal policy makes you a responsible driver.

That’s a lie. A calculated, profitable lie.

Think of it this way: the state requires a fire extinguisher in your house. The insurance company sells you one the size of a travel hairspray can. When your kitchen goes up in flames, are you protected? Technically, yes. Practically? You’re ruined.

That tiny extinguisher is Colorado’s minimum liability coverage. It exists to satisfy a line in a statute — and absolutely nothing more. It was never meant to make you whole after a serious wreck involving modern cars and today's insane medical costs. Its real job is to give you the illusion of security while exposing you to the maximum possible financial risk.

Why? Because it keeps their premiums looking cheap, luring you in. It’s a business model built on your potential bankruptcy. We see the fallout every single day.

What Are The Minimum Auto Insurance Requirements In Colorado?

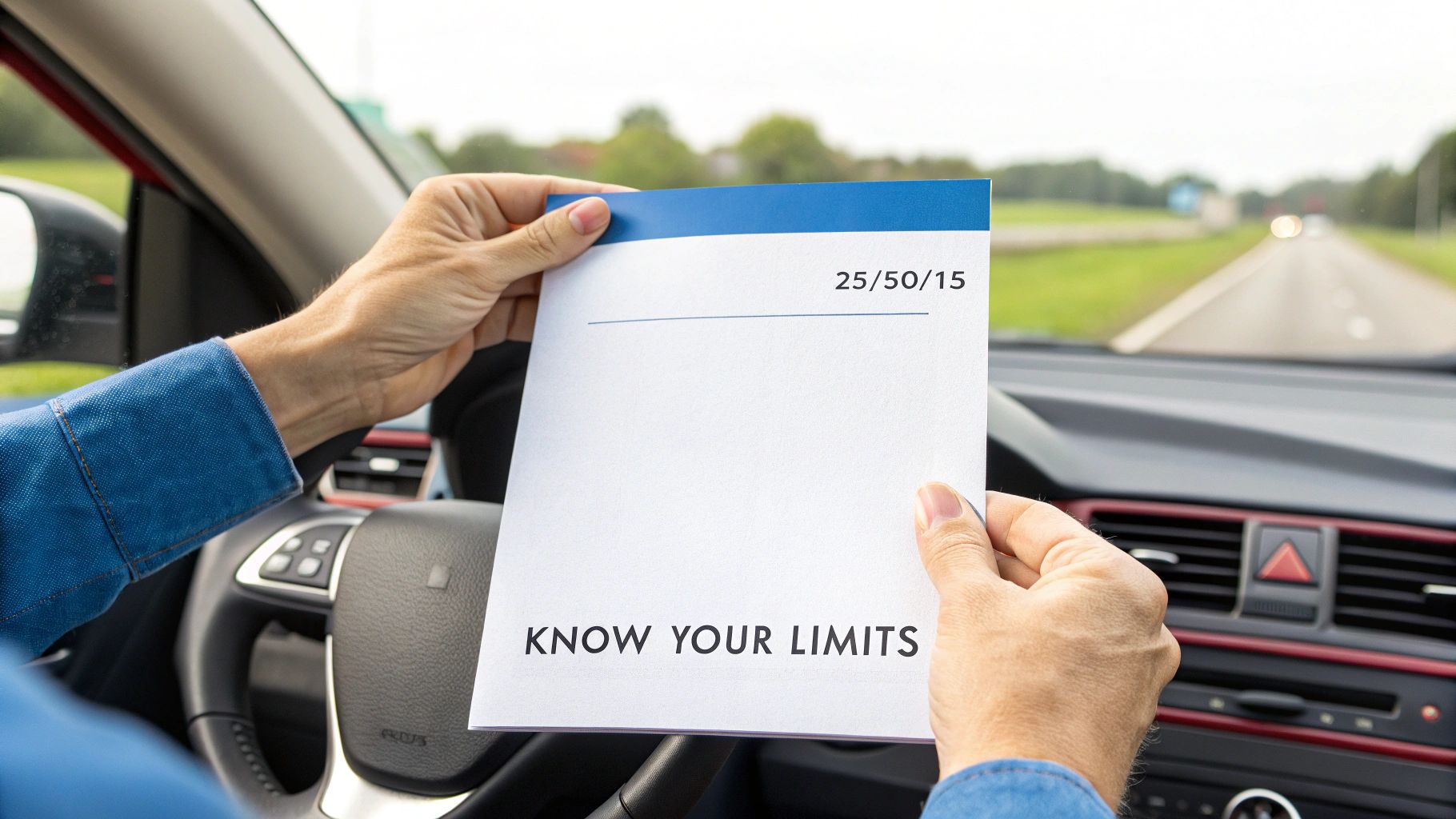

Let's cut the crap. Colorado has set the absolute rock-bottom, legal minimum for auto insurance, and it's boiled down to a dangerously simple shorthand: 25/50/15.

This isn't some secret code. It's the barest of bare minimums you can carry to legally drive without getting a ticket. And insurers are thrilled to sell you a policy with these limits — knowing full well it offers about as much protection as a paper umbrella in a hailstorm.

It’s just enough to be legal. It’s nowhere near enough to be safe.

The Problem With 25/50/15 Liability Limits

So, what does 25/50/15 actually mean when you cause a crash? This is liability coverage — the part of your policy that pays for the other person's injuries and damages. It’s supposed to protect your assets, not fix your car or pay your own bills.

Here’s the official — and frankly, terrifying — breakdown:

$25,000 for Bodily Injury Per Person: The absolute most your insurance will pay for a single person’s medical bills if you're at fault. An ambulance ride and an ER visit can burn through that $25,000 in a flash.

$50,000 for Bodily Injury Per Accident: If you injure multiple people, this is the total pot of money for all of them combined. It doesn’t matter if two, three, or four people are seriously hurt — once that $50,000 is gone, it’s gone.

$15,000 for Property Damage Per Accident: This is what your policy pays to fix or replace the other driver's car. With the average new car costing around $48,000, this limit is a sick joke. It might not even cover a modern bumper packed with sensors.

Once these pathetic limits are exhausted — and they will be, fast — the injured people can and will come after you personally for every dollar left. Your savings, your home, your future wages — all of it is on the line.

The state minimum isn’t real protection. It’s just a permission slip to drive that leaves you one bad day away from financial ruin.

Colorado Minimum Auto Insurance Requirements At A Glance

| Coverage Type | Minimum Legal Requirement | What It Actually Covers |

|---|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident | The other party's medical bills, lost wages, and pain/suffering when you are at fault. |

| Property Damage Liability | $15,000 per accident | Repair or replacement costs for the other party's vehicle or property (like a fence or mailbox). |

| Medical Payments (MedPay) | Must be offered at $5,000 (can be rejected in writing) | Your own and your passengers' initial medical expenses, regardless of fault. |

| Uninsured/Underinsured Motorist (UM/UIM) | Must be offered at 25/50 (can be rejected in writing) | Your own medical expenses if the at-fault driver has no insurance or not enough insurance to cover your bills. |

As you can see, the truly critical coverages are the ones they let you turn down. Don't.

The “Optional” Coverage That’s Anything But

Beyond the laughable liability limits, Colorado law forces insurers to offer you two other vital types of coverage. They have to put them on the table — but they’re secretly hoping you’ll reject them in writing to save a few bucks a month.

Do not fall for this. It's one of their oldest, dirtiest tricks.

They downplay this coverage because when you sign that waiver, their risk evaporates and yours skyrockets. Here’s what you must have:

Medical Payments (MedPay) Coverage: Think of this as your no-questions-asked medical fund. It pays for your immediate medical bills (and your passengers') right after a crash, regardless of who was at fault. It covers health insurance deductibles, co-pays, and ambulance rides, ensuring you get care without delay. Insurers must offer you $5,000. Take it. Always.

Uninsured/Underinsured Motorist (UM/UIM) Coverage: This is, without a doubt, the most important coverage you can buy. It protects you when the at-fault driver has no insurance or — more likely — has a cheap, state-minimum policy that can’t cover your serious injuries. With about 16.3% of Colorado drivers on the road completely uninsured, this is your only real safety net. For a deeper dive, read our guide on what is bodily injury liability coverage.

An insurance company's goal is simple: collect the most in premiums while paying out the least in claims. Letting you opt out of the coverage that protects you most — MedPay and UM/UIM — is a key part of their profit strategy.

The High Cost Of Lowballing Your Coverage

Driving without insurance in Colorado isn’t just a risk — it’s a choice to play Russian roulette with your financial future. And the consequences aren’t a slap on the wrist. They cascade from bad to life-altering with terrifying speed.

Just getting caught is designed to hurt. You're looking at hefty fines, points on your license, and an almost certain suspension. That alone can derail your ability to work and live.

But the real punishment — the one that follows you for years — is the dreaded SR-22 requirement. It’s a special certificate your insurer has to file with the state, branding you as a high-risk driver. Your premiums will skyrocket, and that scarlet letter stays with you for a long, long time.

The True Cost of an At-Fault Accident

A ticket is one thing. Actually causing a crash with inadequate insurance is another universe of financial pain. This is where the theoretical penalties become a grim, mathematical reality.

Imagine you cause a multi-car pileup on C-470. You have the state minimum 25/50/15 coverage because you thought you were being frugal. Several people are injured. The total medical bills soar past $150,000.

Your policy taps out at the $50,000 per-accident limit before the first surgery is even scheduled. What happens next? You are now personally on the hook for the remaining $100,000. And that doesn't even touch the property damage, which likely blew past your laughable $15,000 limit the moment you hit that first SUV.

When your insurance runs out, the legal system will not just shrug its shoulders and wish you well. The other side’s lawyers will come for everything you have — and everything you will ever have.

This isn't a scare tactic. This is the grim reality that walks through my doors every week. It is the reason we fight so hard against insurance companies and their flimsy, inadequate policies.

From Bad Day to Financial Ruin

So how do they get that money from you? They don’t just send a polite bill. They take it. A court will grant judgments against you, giving them the legal power to seize your assets.

- Wage Garnishment: A court order forcing your employer to send a chunk of every paycheck directly to the people you owe — before you ever see it.

- Property Liens: They can place a lien on your house, your car, or any other property you own. You can't sell or refinance it without paying them first.

- Bank Account Levies: They can get a court order to freeze your bank accounts and take the money directly out.

These are not empty threats. This is the standard playbook. You could spend the rest of your working life paying off a few seconds of a bad decision — the decision to carry coverage that only met the barest of auto insurance requirements in Colorado.

Even a simple side mirror replacement cost can be surprisingly expensive. Now multiply that by a thousand for a hospital stay. The minimum isn't protection — it's a permission slip for financial catastrophe.

The One Policy Upgrade That Can Save You

If you read nothing else, read this. If you take one piece of advice and burn it into your brain, make it this one.

The single most important decision you will make about your auto insurance — the one that separates financial security from utter ruin — is your choice about Uninsured/Underinsured Motorist (UM/UIM) coverage.

This isn't just another line item. It's a shield. It is the only thing standing between you and the reckless, irresponsible, and illegally uninsured drivers swarming Colorado’s roads. And believe me, there are a lot of them.

Current data suggests that roughly one in every six drivers sharing the road with you has no insurance at all. None. They are a catastrophic risk to you and your family, and when they cause a wreck, they often just walk away, leaving you with the wreckage and the bills.

This is where UM/UIM coverage becomes your personal hero. It’s insurance you buy to protect yourself from the carelessness of others.

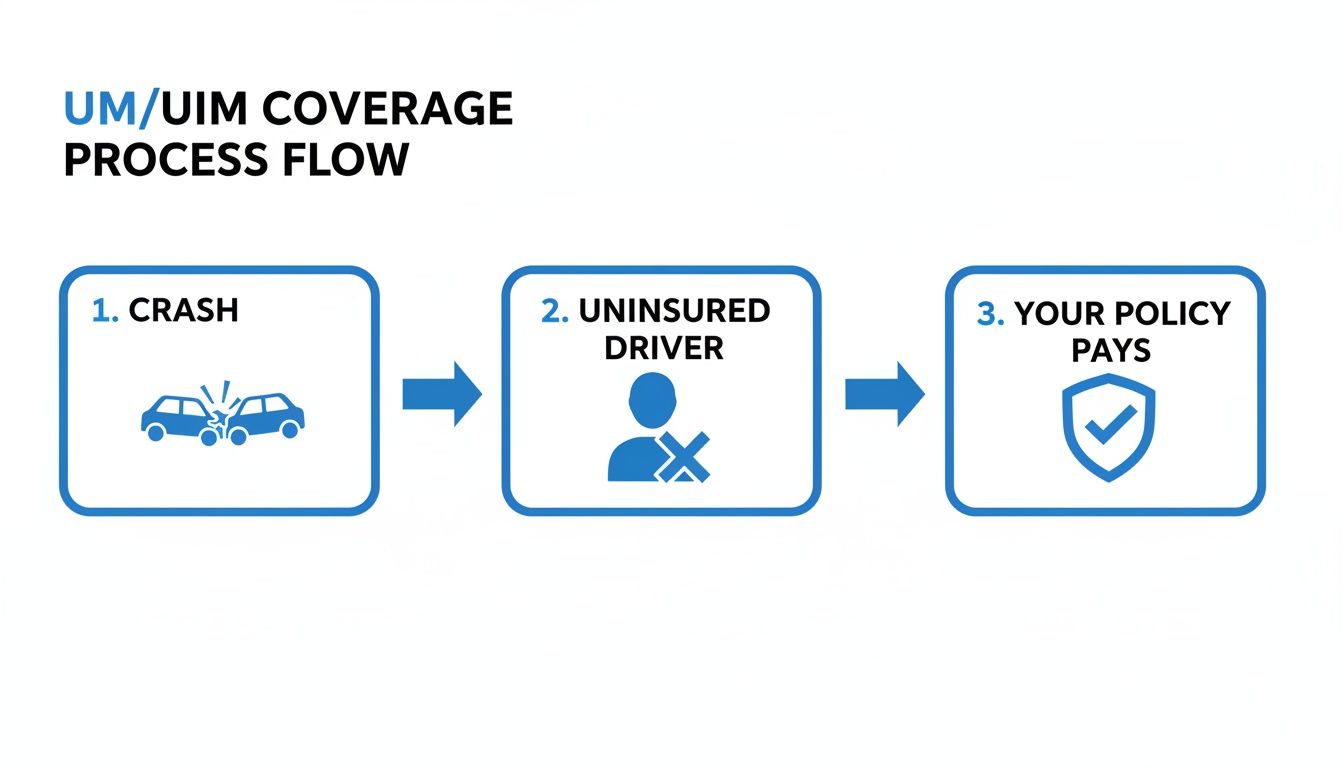

How Uninsured Motorist Coverage Actually Works

Let’s make this simple. You’re stopped at a red light. You’re violently rear-ended by someone texting. The crash is clearly their fault, your car is mangled, and your neck is screaming in pain.

The other driver has no insurance. Now what? Your medical bills start rolling in — ER, MRI, physical therapy. They quickly hit $75,000. Who pays?

Not the at-fault driver — they’re a ghost. This is where your Uninsured Motorist (UM) coverage steps in. It acts as if it were the at-fault driver’s insurance, covering your medical bills, lost wages, and pain/suffering up to the limits you chose. Without it, you’d be on your own.

Your UM/UIM coverage is the ghost policy that shows up when the other driver’s is missing. It’s the only reliable safety net.

The Underinsured Motorist Trap

The "underinsured" part is just as critical. Let's say the driver who hit you does have insurance — the glorious, state-mandated 25/50/15 minimum.

Your medical bills are $100,000. Their policy pays out its maximum of $25,000. You're still staring at a $75,000 mountain of debt.

This is where your Underinsured Motorist (UIM) coverage kicks in. It pays the difference between your total damages and the at-fault driver’s pathetic policy limit. It fills the gap — a gap that could otherwise swallow your financial life. If you're wondering how to navigate this, an uninsured motorist lawyer in Denver can protect your rights.

The Dirtiest Trick Insurers Play

Here’s where my blood boils. Insurance companies are legally required to offer you UM/UIM coverage in Colorado. But they have a dirty little secret — they love it when you reject it.

They will happily let you reject this coverage in writing. Why? Because when you do, they erase a massive amount of their own financial risk and transfer it directly onto your shoulders. It’s a calculated, predatory move.

Never, ever reject UM/UIM coverage. The savings are an illusion. Aim for at least 100/300 ($100,000 per person / $300,000 per accident) or, even better, 250/500. It’s the one part of the auto insurance requirements in Colorado where you have the power to truly protect yourself.

What To Do When The Worst Happens

A car crash is pure chaos. In an instant, your world is screaming metal and shattering glass. But your response needs to be the exact opposite: calm, methodical, and laser-focused on protecting yourself.

This is your playbook. The steps you take right after a crash can shape your recovery for years to come. There is zero room for error.

Your Post-Crash Checklist

Secure the Scene & Check for Injuries. Safety first, always. Move your car if you can, hazards on. Check on everyone. Call 911 immediately to report the crash and any injuries.

Gather Intel — Don't Negotiate. Get the other driver’s name, address, phone number, and insurance information. A clear picture of their insurance card and driver’s license is perfect. Be polite but firm.

Document Everything. Your phone is your most powerful tool. Take photos and videos of everything: damage to all cars from every angle, the position of the cars, skid marks, street signs, visible injuries. You cannot take too many pictures.

Find Witnesses. Independent witnesses are gold. If anyone saw what happened, get their name and phone number. A neutral third party can dismantle an insurance company's flimsy defense.

Seek Medical Attention. Even if you feel fine, go to an urgent care or the ER. Adrenaline is a powerful painkiller. Any gap in medical treatment is a gift to the insurance company.

What You Must Never Do

The things you don't do are just as critical.

Do not apologize. Never say "I'm sorry." An apology will be twisted into an admission of fault, and they will use it against you.

Do not agree to give a recorded statement to the other driver’s insurance adjuster. This is the oldest—and most dangerous—tactic in their playbook. An adjuster will call you, acting like your best friend. They’ll just want to "get your side of the story." That recording is a weapon they will use to pick your words apart and deny your claim.

It bears repeating: The other driver’s adjuster will call, act friendly, and ask for a recorded statement they can use to deny your claim. Politely decline and tell them your attorney will be in touch. Then, call one. Be mindful that strict timelines apply; you can learn more in our guide on how long you have to report an accident to insurance.

Disclaimer: This blog post is for informational purposes only and does not constitute legal advice. Every case is unique, and you should consult with an attorney to discuss the specifics of your situation. Reading this blog does not create an attorney-client relationship.

It’s a lot, I know. But you don’t have to figure this out alone. Give us a call. The consultation is always free.

Written by

Conduit Law

Personal injury attorney at Conduit Law, dedicated to helping Colorado accident victims get the compensation they deserve.

Learn more about our team