Table of Contents

The phone rings. Unknown number. You answer, and a shockingly pleasant voice on the other end introduces herself. She’s an adjuster for the guy who just T-boned you at a stop sign. She sounds so helpful—so concerned.

She is not. She is a smiling assassin.

That first call is a masterclass in misdirection. It’s an ambush disguised as a courtesy check-in. The adjuster’s goal is singular and ruthless—protect her employer’s money by paying you as little as humanly possible. She isn't calling to see if you’re okay; she’s probing for weaknesses.

a) You say you’re just a “little sore”? She writes it down. b) You apologize out of pure politeness? She calls that an admission of fault. c) You mention that old college soccer injury? She’ll use it to argue your pain is pre-existing.

This isn’t a conversation—it’s an interrogation. As a plaintiffs’ lawyer who has recovered over $50 million for Colorado injury victims, I know their playbook by heart. This guide shows you exactly how to deal with insurance adjusters by turning their own predatory tactics against them. You have more power than you think. Let’s use it.

The Recorded Statement Is a Trap—Full Stop

That first phone call is their best shot to catch you off guard. You’re shaken up, maybe on pain meds, and you definitely don’t know the rules of the game you’ve just been forced to play.

They are listening for one thing—a recorded statement. They’ll call it a “formality” or a “standard procedure” to get your claim moving. This is a lie.

It’s a trap. A slight misstatement, a guess about speed, a moment of confusion—it all becomes permanent “testimony” they can use to shred your credibility later.

You are under no legal obligation to give a recorded statement to the other party's insurance company. Ever. Just say, "I won't be providing a recorded statement." Repeat as necessary. No explanation required.

What to Say / What to Never, Ever Say

Your mission on that first call is simple—give them nothing. Be a polite, professional brick wall.

What you SHOULD do:

- Get their info first: Full name, direct number, email, and the claim number.

- Confirm the basics: Your name, address, phone number. The date and location of the crash. That’s it.

- Keep it short: “Thank you for the information. I can’t discuss the details right now, but I will be in touch.”

What you MUST NOT do:

- Don’t Discuss Injuries: When they ask how you feel, your only answer is, “I’m still under medical care.” Saying “I’m fine” or “just sore” will be used against you when the real pain sets in.

- Don’t Apologize: “I’m sorry” is adjuster-speak for “I’m at fault.”

- Don’t Guess: If you don’t know, say, “I don’t have that information.” Speculation is their ammunition.

- Don’t Mention Past Injuries: Your medical history is none of their business.

You control the narrative from day one. You signal that you’re not an easy mark. This is your first lesson in how to deal with insurance adjusters—and the most important one.

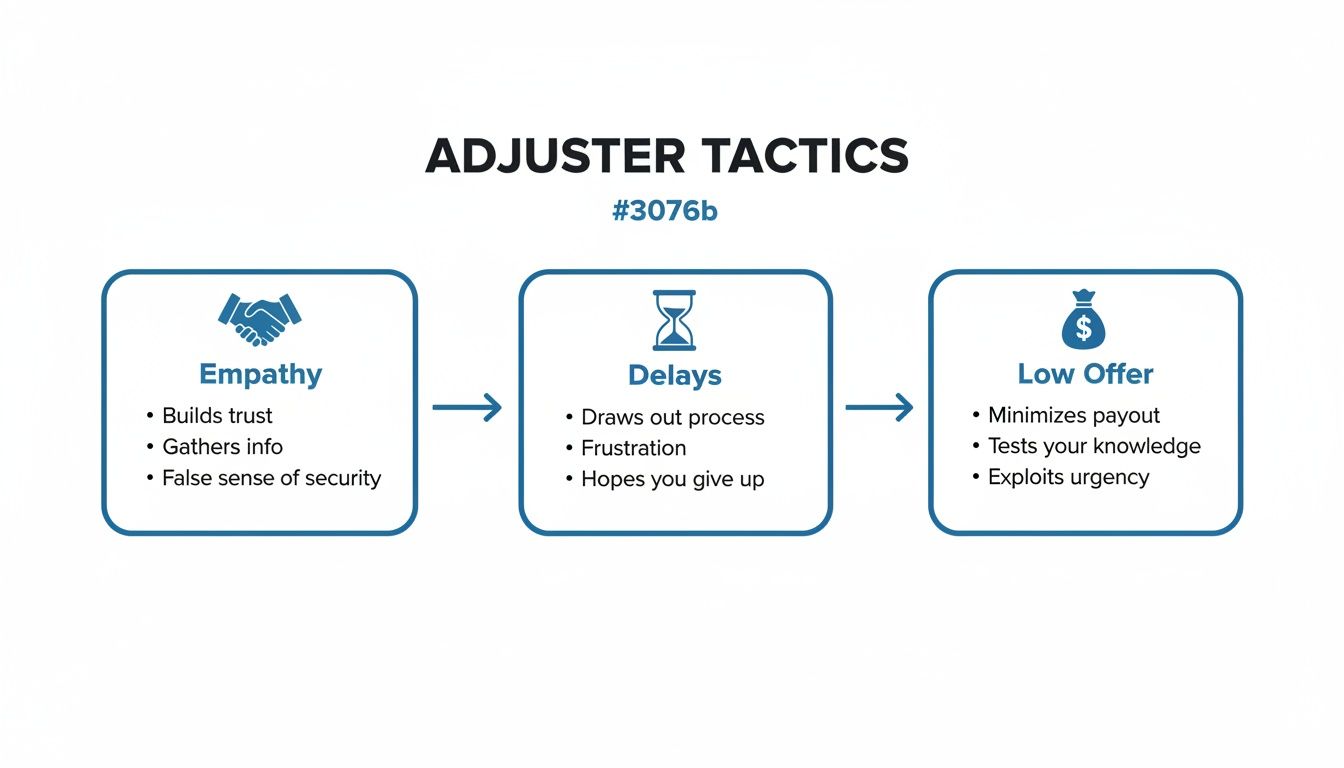

Their Playbook of Predatory Tactics Is Shockingly Simple

Insurance adjusters aren’t creative geniuses—they’re assembly-line workers using a well-worn playbook of psychological tricks. The goal is always the same: wear you down and pay you less.

It all starts with feigned empathy. That friendly voice is a calculated performance, designed to make you feel like they're on your side. Once you see the strings, you can’t unsee them.

Tactic #1: The Delay Game

Their most effective weapon is silence. After that first call, the adjuster might go dark for weeks, even months. This is a strategy.

They know your medical bills are piling up. They know you need your car fixed. They are weaponizing your own financial anxiety against you.

When they finally reappear with an offer, they’re betting you’ll be so desperate for any money that you’ll grab the scraps they’re offering. It’s cruel—and it works all too often.

Tactic #2: The Quick Lowball Offer

This is the classic. Days after the crash, the adjuster calls with what sounds like a lifeline. A few thousand dollars to “help you out” and “put this all behind you.”

This is not kindness. It’s a predatory tactic meant to erase their long-term liability for a pittance.

They are dangling cash in front of you, hoping you’re worried about next month’s rent. They know your future medical needs could be ten times that amount, and they want you to sign away your rights before you figure that out. The quick lowball offer is their opening move, designed to anchor your expectations as low as humanly possible.

Tactic #3: Misrepresenting Your Coverage

Another slick move is to simply lie about the policy. An adjuster might tell you the policy limit is only $25,000, conveniently forgetting to mention other layers of coverage that might exist.

They’ll tell you physical therapy/chiropractic care isn’t “medically necessary” and won’t be covered. This is almost always a bluff designed to make you panic.

They are banking on the fact that you haven’t read the dense, jargon-filled insurance policy. Never take their word for what is—or isn’t—covered. It’s their job to mislead you.

The quick lowball offer is their favorite trick because it preys on your immediate financial anxiety. Recognizing this tactic for the insult it is means refusing to bite.

You Win by Building a Claim They Cannot Ignore

Alright, enough defense. It’s time to go on offense.

You don’t beat an adjuster by playing their game—you win by building a fortress of evidence so strong their lowball tactics simply crumble against it. This is how you build a claim they can’t ignore.

The Foundation: Cold, Hard Numbers

First, gather every piece of paper with a dollar sign on it. Become the archivist of your own recovery.

- Every Medical Bill: Ambulance, ER, MRIs, specialists, follow-ups. All of it.

- Every Prescription Receipt: If a doctor prescribed it, it goes in the file.

- Proof of Lost Wages: You need a formal letter from your employer confirming your pay rate and the exact dates you missed work—plus pay stubs from before and after the crash.

This is the concrete, black-and-white foundation of your claim. It’s the starting point from which all other damages are built.

Your Secret Weapon: The Pain Journal

An adjuster can argue about a bill. It’s much harder for them to argue with your lived, daily reality.

A pain and suffering journal is one of the most powerful tools you have. It transforms abstract legal concepts into a compelling, human story they cannot ignore.

Every day, take five minutes to write down how you feel. Document your pain on a scale of 1-10. Note the struggles—the inability to sleep, the difficulty lifting your child, the frustration of not being able to button a shirt.

It paints a picture of a life interrupted. It gives a voice to the silent costs of the crash. An adjuster sees a file number; your journal forces them to see a human being.

This meticulous documentation is everything. A KFF analysis confirms that while appealing a denied claim succeeds over 50% of the time, less than 1% of people bother to do it—often because their file is a mess. A well-documented claim is an appeal they know you can win. Understanding the full car accident injury claim process empowers you to build a claim that stands up to scrutiny. You are building leverage, piece by undeniable piece.

Negotiating the Settlement Is a Battle of Wills

Let’s be clear: the first offer is an insult. It's a strategic low number meant to anchor the negotiation in their favor. Your job is to ignore it.

You don’t win by arguing on the phone. You win by presenting a formal, written demand letter that puts them on the defensive.

The Power of a Proper Demand Letter

This isn’t a quick email—it’s a comprehensive legal document that lays out your entire case. It signals to the adjuster that you know your rights and you’re not messing around.

A powerful demand letter does four things:

- Establishes Liability: It uses the police report and witness statements to prove their insured was at fault.

- Details Your Damages: It tells the story of your injuries, your treatment, and how the crash has upended your life, backed by your medical records.

- Itemizes Every Dollar: It includes a full accounting of your medical bills, lost wages, and other hard costs.

- Makes a Specific Demand: It ends with a clear, justifiable number that represents the total value of your claim—including your pain and suffering.

Calculating that number is crucial. You can learn more in our guide on how to calculate pain and suffering damages. Having a well-supported figure gives your demand real teeth.

The Back-and-Forth Is Not a Race

Once you send the letter, the real negotiation begins. It’s a patient, methodical process. The adjuster will come back with a counteroffer. It will still be too low.

Don’t let them rush you. High-pressure tactics are just more games. Every time you counter, you justify it with evidence. They question a bill? You send them the doctor’s note explaining why it was necessary. Mastering the art of insurance adjuster negotiation is about calm, evidence-based persistence. The person with the better file almost always wins.

When It’s Time to Call in the Heavy Artillery

Look, you can handle a lot of this yourself. But there are clear lines in the sand. When an adjuster crosses them, you’re in a fight that requires a professional in your corner.

Calling a lawyer isn’t admitting defeat—it’s a strategic move. It’s bringing in a heavyweight when you realize you’re in a heavyweight brawl.

Red Flags That Scream “Lawyer Up”

If you see any of these, it’s time to stop talking to the adjuster and start talking to an attorney.

- They Ghost You: The adjuster who was calling every day suddenly vanishes. This is a deliberate stall tactic.

- They Deny Obvious Fault: They start blaming you when the police report clearly shows their driver was 100% at fault.

- They Make an Impossible Offer: The offer doesn't even cover your documented medical bills. This is profound bad faith.

- They Mention Surveillance: If an adjuster ever says they have you “under surveillance,” it's an intimidation play. Hang up and call a lawyer. Immediately.

The moment a law firm sends a letter of representation, the dynamic shifts. The adjuster can no longer use their standard playbook. They now have to answer to a professional who knows every trick they have. You can learn more about fighting back in our guide on how to appeal a denied insurance claim.

It's about showing them you will not be bullied.

Straight Answers to Your Burning Questions

You’ve got questions. After years of fighting these companies, I’ve heard them all. Here are the straight, no-nonsense answers.

Should I Sign the Medical Authorization Form They Sent?

No. Absolutely not. It’s a trap.

These forms grant them sweeping, unlimited access to your entire medical history—from childhood asthma to that old football injury. They will dig for anything they can use to argue a pre-existing condition is the real cause of your pain.

Don’t give them the ammunition. Only provide medical records directly related to this specific accident.

How Long Do I Have to File a Claim?

This depends on your state’s statute of limitations. Deadlines are unforgiving.

In Colorado, you generally have three years from the date of a car accident to file a lawsuit. But don’t wait. The insurance company has its own shorter deadlines for reporting a claim. They love it when you delay—it lets them argue your injuries weren’t that serious.

What if They Say I Was Partially at Fault?

Breathe. This is a predictable, cynical tactic designed to slash your settlement value under Colorado’s comparative negligence laws.

Do not argue with them on the phone. This is where your evidence speaks for you. Present the police report, witness statements, and photos that prove the other driver was 100% at fault in your formal demand letter. This isn’t a conversation for them to dictate—it’s a legal argument you win with facts.

At Conduit Law, we deal with adjusters every single day. We know their games, we know their playbook, and we know how to beat them. If you’re feeling overwhelmed or you’ve hit a wall, give us a call. I got you.

Disclaimer: This blog post is for informational purposes only and does not constitute legal advice. Reading this post does not create an attorney-client relationship. Every case is unique, and you should consult with a qualified attorney to discuss the specifics of your situation.

- Ready to fight back? Contact the attorneys at Conduit Law 24/7 for a free case evaluation. We’re here to help you get the justice you deserve. https://conduit.law

Written by

Conduit Law

Personal injury attorney at Conduit Law, dedicated to helping Colorado accident victims get the compensation they deserve.

Learn more about our team