Table of Contents

Here’s the answer insurance companies don’t want you to hear, but it’s the only one that matters: Report your accident immediately. Right now. Stop reading this, call your insurer, then come back. I’ll wait.

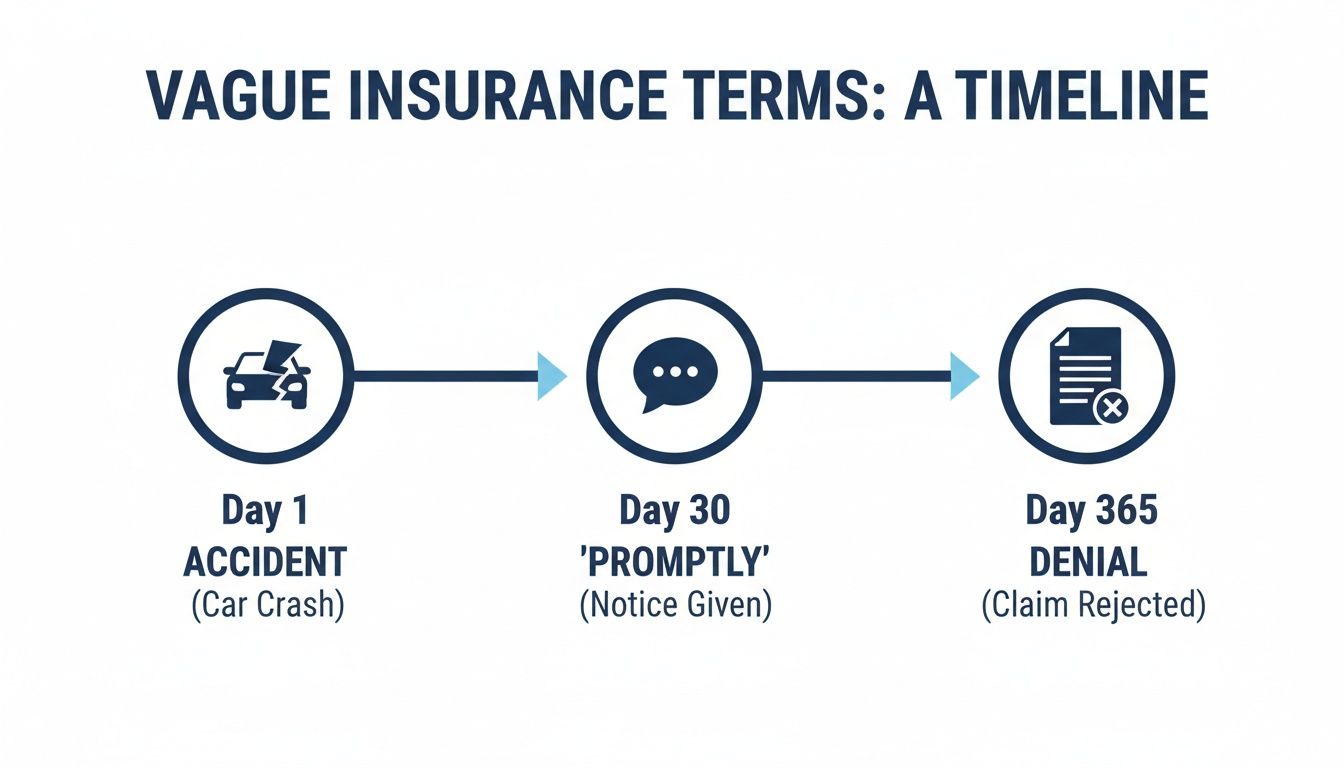

Why the fire drill? Because your insurance policy—that legal document drafted by a legion of lawyers richer than you and me—is a trap. It’s designed with vague, insidious phrases like “prompt notice” or “as soon as practicable.” These aren’t friendly suggestions. They are loopholes. They are weapons. And every single hour you wait to report a crash, you are handing your insurer a bigger, sharper weapon to use against you.

The scene: you’re on Speer, minding your own business, and bam. Someone plows into your bumper. You’re dazed. You’re dealing with cops, maybe paramedics. Your brain is a scrambled mess of adrenaline and anxiety. The last thing you’re thinking about is your GEICO app. Your insurance company knows this. In fact, they’re counting on it. They want you to wait. It makes their job—the job of paying you as little as humanly possible—infinitely easier.

This is your guide to slamming that door shut.

The Trick Insurance Companies Don’t Want You to Know

There are two clocks ticking after a car accident. Confusing them is the most expensive mistake you can make. It’s a gift to the adjuster.

Clock #1: The Policy Deadline. This is the insurer’s clock. It lives in the fine print of your contract and uses weasel words like “promptly.” To them, this means 24-72 hours. Maybe a week, if they’re feeling generous—which they never are.

Clock #2: The Legal Deadline. This is your clock, set by Colorado law. It’s called the statute of limitations. For a car wreck, it’s a hard-and-fast three years to file a lawsuit for your injuries.

They are not the same thing. Not even close.

Waiting a year to sue is your legal right under the Colorado personal injury statute of limitations. Waiting a year to report the crash to your insurer is claim suicide. They will deny it so fast your head will spin, crying that you violated the “prompt notice” clause of your policy. It’s their favorite trick. They use your own contract against you to escape paying what they owe.

Your Policy’s Weasel Words Are a Weapon

Your insurance policy is not a partnership. It is a one-sided contract written by their lawyers to protect their money. The most dangerous section is the part about your duties after a loss—specifically, the reporting deadline.

“Promptly.” “Without unreasonable delay.” “As soon as practicable.”

These phrases are intentionally vague. They’re legal quicksand. They give the adjuster total power to decide, after the fact, that you were too slow. It’s a game you can’t win.

- You wait 24 hours? “Why the delay? Must not be hurt that badly.”

- You wait a week? “A whole week? Evidence is gone. Memories are faded.”

- You wait a month? “You’ve prejudiced our investigation. Claim denied.”

It’s a cynical, calculated trap. Don’t play their game.

They know common insurance claim denial reasons and how to avoid them start with creating doubt. A delay is the easiest way to do it. Their entire strategy is to get you to violate their vague policy timeline long before you’ve even had a chance to think about your legal options.

The Real Deadlines for Different Colorado Accident Claims: How Long to Report Accident to Insurance

Let’s get tactical. Thinking one deadline fits all is a mistake—and a costly one. Your insurance company treats different claims with different levels of scrutiny.

How fast you act changes dramatically depending on the specifics. This isn’t about following rules; it's about building the strongest case from the first second.

Time is a weapon—make sure you’re the one wielding it.

Bodily Injury Claims

If you are hurt, the clock is screaming. Any delay gives the adjuster a golden opportunity to argue your injuries aren’t from the crash.

Their logic is monstrously simple: If you were really hurt, you would have called us from the ambulance. It doesn’t matter if you were in shock. To them, a two-day delay is proof you were feeling fine.

Report the accident and your injury within 24 hours. You don’t need a diagnosis. You just need to say, “I was in an accident, and I was hurt. I’m getting medical care.”

Property Damage Claims

When it’s just your car, the urgency is more practical. You need your ride fixed.

Waiting a week isn’t smart. Evidence gets complicated. If your car sits in a tow yard racking up storage fees, the insurer might refuse to cover those extra costs. Call them within 24-72 hours.

Uninsured/Underinsured Motorist (UIM) Claims

This is where it gets nasty. The at-fault driver is a ghost/deadbeat, so you have to use your own policy. Suddenly, your friendly insurer becomes your opponent.

They will scrutinize your compliance with a microscope. Many UIM provisions have stricter notification rules. Miss that tiny window, and you could lose the right to the coverage you paid for.

Hit-and-Run Accidents

The other driver flees. You have two calls to make—immediately. First, 911. Second, your insurer. There is zero wiggle room.

To make a UIM claim, you must prove you took immediate steps to find the driver. A prompt police report is non-negotiable proof. Waiting even a day gives the insurer the perfect excuse to deny you. Just ask our clients from cases involving Denver snow plows who learned that prompt, precise action is everything.

| Type of Claim | Recommended Reporting Time | Typical Policy Deadline | Colorado Statute of Limitations (to sue) |

|---|---|---|---|

| Bodily Injury | Within 24 hours | "Promptly" or "As soon as practicable" (Interpreted as 30 days or less) | 3 years for motor vehicle accidents |

| Property Damage | Within 24-72 hours | "Promptly" or "As soon as practicable" | 3 years for motor vehicle accidents |

| UIM / Hit-and-Run | Immediately (within hours) | Often has specific, shorter deadlines (e.g., within 30 days) | 3 years from the date of the accident |

The Punishment for Waiting is Swift and Brutal

Let's be perfectly clear—every minute you delay reporting an accident, you are handing the insurance company a weapon. This isn't a maybe; it's a guarantee. Their business model is built on finding reasons to pay you less.

When an adjuster sees a gap between the crash date and the report date, a switch flips in their brain. They stop investigating your claim and start building a case against you. Here’s their playbook:

They will argue the delay prejudiced their ability to investigate. This is their go-to excuse. They’ll claim your “failure to provide prompt notice” robbed them of a “timely” investigation.

They will claim crucial evidence has disappeared. Skid marks fade. Debris gets cleared. Cars get salvaged. You just gave them the perfect excuse not to look for evidence that would have helped you.

They will insist witness memories are now unreliable. They’ll argue that any witnesses you find now have fuzzy recollections, making their testimony worthless.

They will insinuate your injuries aren’t that serious. This one is particularly cruel. They’ll look at a week-long delay and say, “If you were in that much pain, you would’ve called from the ER.”

The core of their argument is a twisted legal concept called “prejudice.” They posture as the victim of your inaction.

They will argue the delay prejudiced their ability to investigate. It’s a disgusting and dishonest tactic. They aren’t sad about lost evidence—they are thrilled. When an insurer wrongfully denies a valid claim like this, they may be breaking the law. You can fight back by understanding Colorado insurance bad faith law and what your rights are.

How to Report an Accident Without Wrecking Your Claim

That first call is not a friendly chat. Assume every word is being recorded and scrutinized. Your only job is to fulfill your contractual duty while protecting your legal rights.

Stick to the script. Give them only the bare minimum.

- Review Your Policy First. Before you dial, pull up your declarations page. Know your coverage.

- Stick to the Facts—And Only the Facts. Your name, policy number, date, time, and location. Identify the other driver if you have their info. That’s it. Stop talking.

- State You Are Injured and Seeking Medical Care. Use these exact words: “I have been injured and I am seeking medical attention.” This puts it on the record.

- Refuse to Give a Recorded Statement. The adjuster will ask. Your answer is a polite but firm “No.” It is a trap, plain and simple.

- Never, Ever Admit Fault or Speculate. Don’t apologize. Don't guess. A simple “I’m sorry” can be twisted into an admission of guilt.

- Get Your Claim Number. Before you hang up, get the claim number and the adjuster’s full name and contact info. Document everything.

They are not trying to help you with a recorded statement. They are hunting for inconsistencies. You're hurt, in shock, and running on adrenaline. It’s the perfect time for them to catch you in a mistake. Refusing isn't an admission of guilt—it’s an assertion of your right to be careful.

“Feeling Fine” is the Most Dangerous Lie You Can Tell

Adrenaline is a liar. In the moments after a wreck, it floods your system and masks pain. It’s a survival mechanism. It’s also a gift to the insurance company.

Countless people walk away from a crash, say “I feel fine,” and put off calling a doctor/insurer. When the adrenaline wears off hours or days later, the real damage makes itself known. By then, it’s too late. The adjuster has their argument locked and loaded: “You said you were fine at the scene.”

- Whiplash: Pain and stiffness often take 24-48 hours to fully manifest.

- Concussions and Brain Injuries: Confusion, dizziness, and memory problems can surface days later. It's crucial for understanding concussion symptoms and protecting your health.

- Internal Bleeding: A life-threatening emergency that can start with subtle signs long after impact.

The bottom line is this: “Feeling fine” means nothing. Assume you are injured until a doctor tells you otherwise. Report the accident and the potential for injury immediately. This one step protects you from the harm you don’t even know you have yet.

The moments and days after a car accident are disorienting, but you don’t have to face the insurance companies by yourself. At Conduit Law, we deal with the adjusters, the paperwork, and the fight so you can focus on getting better. If you’ve been hurt, give us a call. We’ll talk through your options, and you won’t pay us a dime unless we win your case. It’s that simple. Let’s talk.

Disclaimer: This blog post is for informational purposes only and does not constitute legal advice. Reading this post does not create an attorney-client relationship. Every case is different, and you should consult with a qualified attorney to discuss the specifics of your situation.

Let’s start the conversation. Call or text us 24/7 for a free, no-obligation consultation about your case. You can reach us at (303) 848-HURT or schedule your free case review online. I got you.

Written by

Conduit Law

Personal injury attorney at Conduit Law, dedicated to helping Colorado accident victims get the compensation they deserve.

Learn more about our team