Table of Contents

You’re driving through a green light in Denver when—bam—someone turning left smashes into your passenger side. You’re hurt, your car is wrecked, and your life is suddenly a chaotic mess of doctor visits and missed work.

A few days later, you get a call. It’s the other driver’s insurance adjuster. They sound so… nice. So concerned. And then, a few minutes into the conversation, they slip it in.

A) “So, you were driving a dark-colored car at dusk?” B) “Were you maybe going just a little over the speed limit?” C) “Did you see them starting to turn at all?”

These aren't innocent questions. They’re scalpels. Each one is a careful, calculated incision designed to slice away a piece of your claim. The adjuster’s only job is to find a way—any way—to pin some of the blame on you. Why? Because under the rules of comparative negligence in Colorado, every percentage point of fault they can shift your way is pure profit for them. Welcome to the fight.

The Trick Insurance Companies Don't Want You to Know

Insurance adjusters aren’t looking for truth. They’re hunting for leverage. Their entire business model depends on minimizing payouts, and their most effective weapon is twisting Colorado's fault laws against you.

They know the law inside and out—especially the parts that can save them a fortune. Their goal from the first phone call is to build a narrative of shared blame. Even if their driver was 99% wrong, they will spend all their time digging for that 1% they can pin on you.

Why? Because pushing even a fraction of the fault your way achieves two things:

- It reduces the value of your claim, dollar for dollar.

- It lays the groundwork to deny your claim entirely.

They want to make you doubt yourself. They want you to think, “Well, maybe I could have braked a little sooner.” That tiny seed of doubt is all they need. It's how they turn a clear case of negligence into a muddy dispute where you end up paying for someone else’s mistake.

This Is the 51% Cliff That Can Obliterate Your Claim

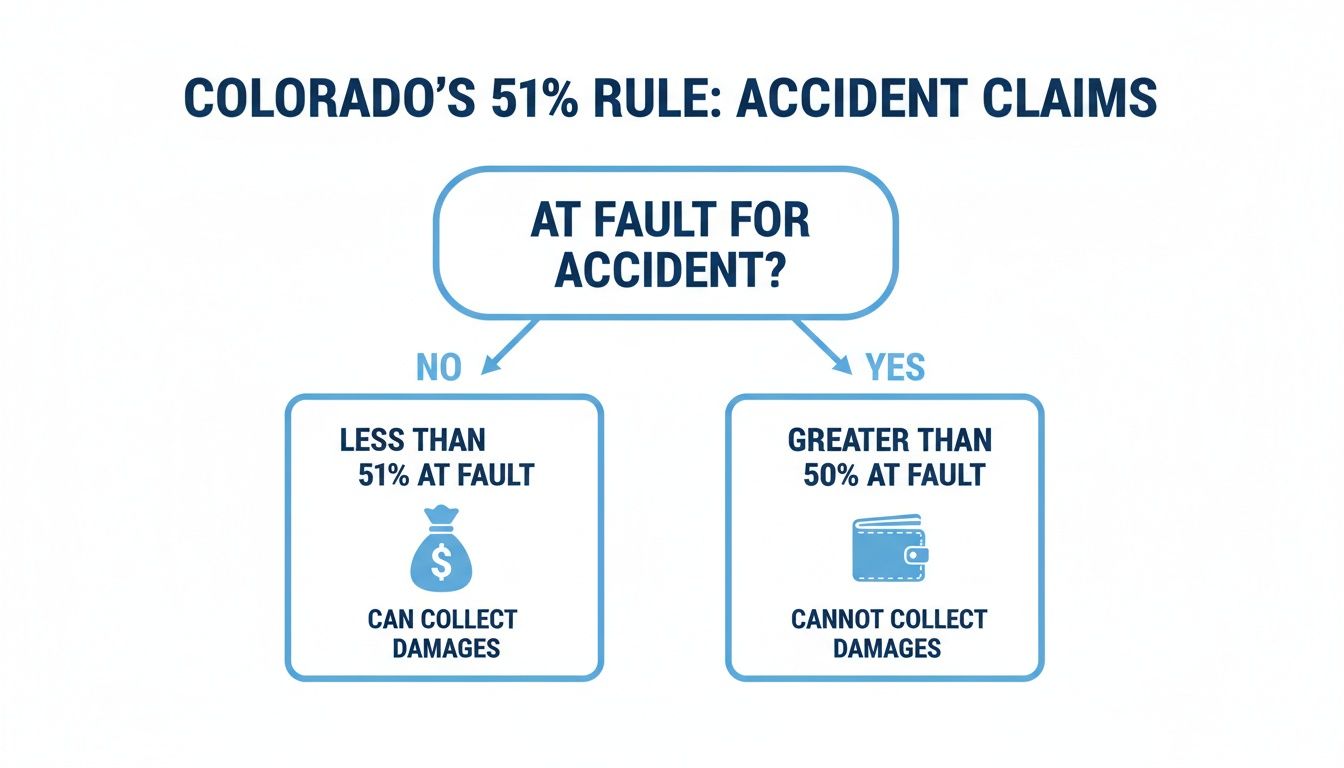

Forget the dense legal jargon of Colorado Revised Statutes § 13-21-111. Here’s all you need to know.

Colorado uses a system of “modified comparative negligence.” It means you can recover money for your injuries as long as a jury finds you are 50% or less at fault. The moment your share of the blame ticks over to 51%, your entire claim evaporates.

You get zero. Zilch. Nada. No money for your medical bills, your lost income, or your shattered peace of mind.

This isn’t an accident. The law creates a brutal, all-or-nothing cliff. And the insurance company’s entire strategy is to push you over the edge. They aren’t just trying to pay you less—they are actively trying to pay you nothing.

This is the cold, hard reality of comparative negligence in Colorado.

As you can see, the difference between 50% fault and 51% fault is the difference between a fair recovery and a total loss. That single percentage point is the battlefield where your entire financial future is won or lost.

How Your Fault Wipes Out Your Money

Let's look at the math. Imagine your total damages are $100,000.

| Your Percentage of Fault | Can You Get Paid? | Your Payout on a $100,000 Claim |

|---|---|---|

| 0% | Yes | $100,000 |

| 30% | Yes | $70,000 (Reduced by your 30% fault) |

| 50% | Yes | $50,000 (Reduced by your 50% fault) |

| 51% | No | $0 (Your claim is completely barred) |

This isn’t how it works everywhere. Some states let you recover even if you're 99% at fault. Colorado doesn’t. Our system gives insurance carriers a perverse incentive to find—or manufacture—just enough blame to disqualify you completely. If you’re curious how this differs from other systems, check out our guide on whether Colorado is a no-fault state.

This Is How They Manufacture Fault From Thin Air

Insurance adjusters are architects of blame. They don't investigate accidents; they build cases against victims. They use a well-worn playbook of psychological tricks and legal misdirection to assign you just enough fault to slash—or erase—your claim.

They are counting on you not knowing the rules of their game. Let's fix that. Right now.

The Recorded Statement Ambush

This is their go-to move. The adjuster calls, sounding like your best friend, and asks for a “quick recorded statement to process the claim.”

Never, ever agree to this without talking to a lawyer.

This isn’t a chat. It's an interrogation. They use leading questions, awkward silences, and feigned sympathy to bait you. An innocent “I’m so sorry this happened” is twisted into an admission of guilt. A hesitant “I guess I didn’t see him until the last second” becomes proof you weren’t paying attention. They aren't looking for context; they're mining for soundbites.

Misrepresenting Colorado Law

Adjusters love to act like legal scholars. They will confidently tell you that because you were changing lanes/turning left/backing up, you are automatically partly at fault. This is often a deliberate misstatement of the law.

Their goal is to create official-sounding justifications for the conclusion they’ve already reached: you’re to blame. It’s a performance designed to intimidate you into accepting a fraction of what you deserve.

Weaponizing Your Medical Care

Couldn't get a doctor's appointment for two weeks? Had to miss a physical therapy session for a family emergency? The adjuster will pounce on this.

They’ll argue any gap in treatment means you either weren’t really that hurt or, even worse, that you made your own injuries worse by not following doctor’s orders perfectly. It's a cynical, disgusting tactic—using the real-world difficulties of your recovery against you. This is where they execute their worst strategy: inflating your fault to zero out your claim.

The Absurdity of Blaming the Victim

Sometimes their arguments are just plain desperate. They’ll blame your choice of footwear in a slip-and-fall. They’ll suggest your music was too loud in a car wreck.

These are just jabs thrown to see what sticks—to make you doubt yourself and wear you down. It all comes back to their prime directive. Remember: inflating your fault to zero out your claim is always the end game.

Here's How the Numbers Actually Work

Let's ground this in reality. The whole concept of comparative negligence in Colorado comes down to the final check—or lack thereof. Here’s what’s really at stake.

Scenario 1: The Aurora Fender-Bender

You get T-boned by someone who ran a stop sign. Total damages: $50,000. The adjuster discovers you were going five miles over the speed limit and assigns you 15% fault.

- The Math: $50,000 - 15% ($7,500) = $42,500.

- The Takeaway: Your “minor” infraction just cost you $7,500.

Scenario 2: The Fort Collins Slip and Fall

You slip on an unmarked wet floor in a grocery store. Your damages, including pain and suffering, total $100,000. The store’s insurer pulls security footage and sees you were glancing at your phone just before you fell. They assign you 30% fault.

- The Math: $100,000 - 30% ($30,000) = $70,000.

- The Takeaway: A moment of distraction—something every human does—is now being used to deny you $30,000. For help with these calculations, see our guide on how to calculate pain and suffering damages.

Scenario 3: The I-70 Pileup

Things get messy. A truck, another car, and you are all involved. Your damages are a life-altering $500,000. A jury decides the truck driver was 60% at fault, the other car was 20% at fault, and you were 20% at fault for following too closely.

- The Math: $500,000 - 20% ($100,000) = $400,000.

- The Takeaway: That 20% sliver of blame just vaporized a six-figure portion of your recovery. This is why we fight over every single percentage point.

Here's Why Building Your Fortress of Evidence Matters

You can’t stop the insurance company from trying to blame you. But you can make their job impossible by building a fortress of evidence around your claim.

In a comparative negligence Colorado case, the person with the best evidence wins. It's that simple. Your word against theirs is a toss-up. Your word backed by a mountain of objective proof is a knockout.

Your Post-Accident Battle Plan

In the chaos after a crash, your phone is your most powerful weapon. Here’s exactly what you need to do.

- Become a Crime Scene Photographer. Take pictures and videos of everything. Vehicle damage, skid marks, traffic signs, debris fields, weather conditions. There is no such thing as too many photos.

- Get the Police Report. It’s not legally binding, but it’s powerful. An officer’s initial assessment of fault can shut down an adjuster’s ridiculous arguments before they even start.

- Collect Witness Intel. Did someone see what happened? Get their name and number. An independent witness is gold. Their unbiased account can dismantle an entire blame-shifting narrative.

- Preserve Your Evidence. Keep everything. Your bloody clothes, your busted helmet, your damaged phone. Don’t repair your car until a lawyer says it’s okay. This is all crucial proof.

Every piece of evidence you gather is a brick in your wall—a barrier that makes it harder for the insurance company to invent its own version of reality. To see how this fits into the bigger picture, check out our guide on the car accident injury claim process.

This all seems overwhelming. I get it. But you don’t have to do it alone.

The insurance company has a team of experts working around the clock to deny your claim. You deserve the same. If you’re hurt and they’re playing games, give me a call. We’ll talk through what happened and figure out a plan. The consultation is always free. I got you.

Disclaimer: This blog post is for informational purposes only and does not constitute legal advice. Reading this post does not create an attorney-client relationship. Every case is unique, and you should consult with a qualified attorney to discuss the specifics of your situation.

Written by

Conduit Law

Personal injury attorney at Conduit Law, dedicated to helping Colorado accident victims get the compensation they deserve.

Learn more about our team