Table of Contents

The phone rings. It’s a chipper, impossibly friendly voice from Big Insurance, Inc. They’re just calling to “check in” after your crash, see how you’re doing, maybe get your side of the story. It feels so… helpful.

It’s a lie.

Every syllable is a carefully crafted trap. That friendly adjuster’s only job—their entire reason for being—is to pay you as little as humanly possible for your shredded car and your shattered life. The car accident injury claim process isn’t a process; it’s a war. It starts the second of impact and it’s you against a multi-billion-dollar machine that has perfected the art of deny, delay, and devalue.

You’re hurt, you’re confused, and you’re staring down a mountain of medical bills. They know this. They’re counting on it. This isn’t just a guide. This is the playbook they don’t want you to have. This is how we fight back.

You Will Not Be Bullied—Here's How We Start

The screech of tires, the punch of steel, the ringing silence after. A car wreck is a violent tear in the fabric of your life. It’s the starting gun for a race you never signed up for, against an opponent that owns the track.

What you do in the first few hours—and what you don’t do—can make or break your entire case. Your adrenaline is lying to you, telling you you’re fine. Don’t listen. Your focus has to be surgical.

The Only Moves that Matter at the Scene

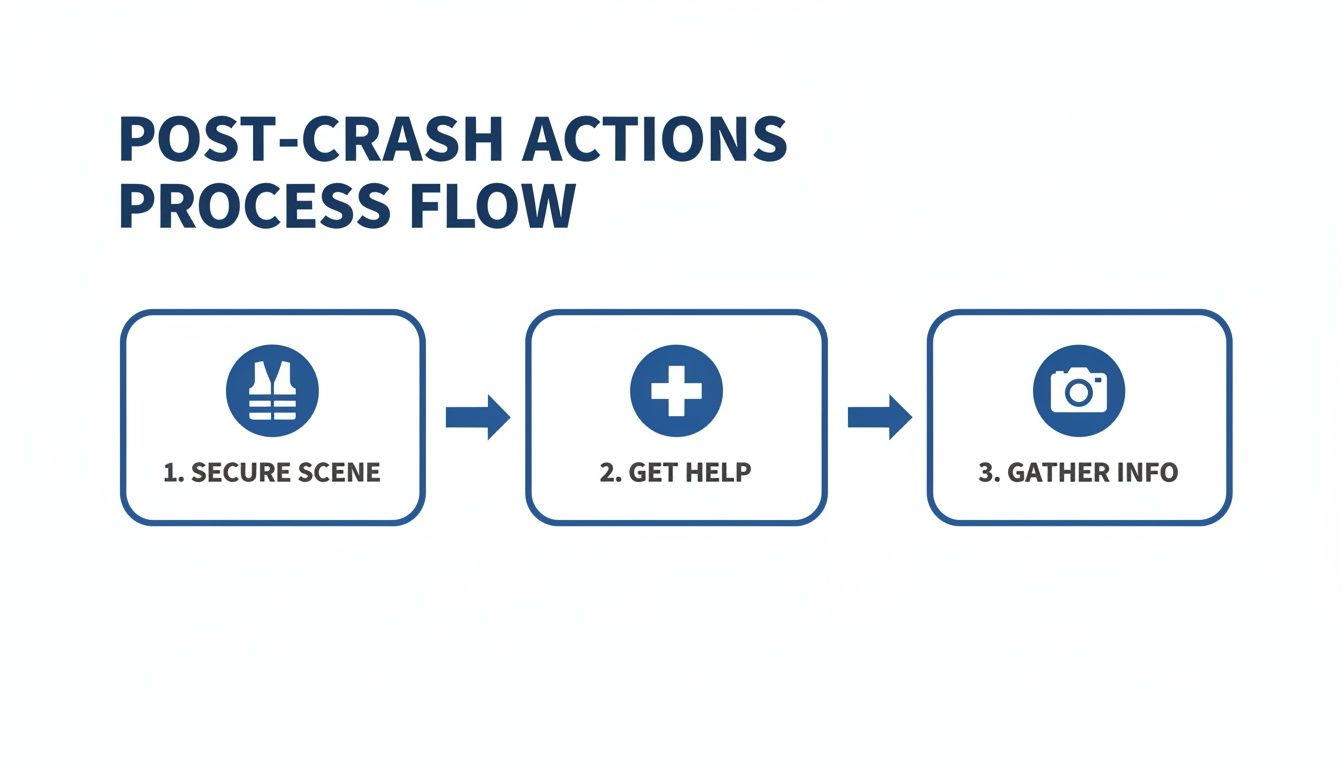

Your hands are shaking. Your thoughts are scrambled. Breathe. You have three jobs. That’s it.

- Secure the Scene/Yourself. If you can, move your car, turn on your hazards. Prevent a second crash. Then call 911. This is not optional. A police report is objective truth. Paramedics create a record of your injuries.

- Shut Your Mouth. Never, ever say “I’m fine” or “I’m sorry.” Adrenaline is the world’s best painkiller—whiplash and concussions often take hours or days to scream. Saying you’re okay is a gift-wrapped present to the insurance adjuster who will use it to hang you.

- Become an Investigator. Your phone is your weapon. Photograph everything—car damage from every angle, skid marks, traffic signs, your injuries. Get a picture of the other driver’s license and insurance card. Get names and numbers from any witnesses.

This is where the car accident injury claim process truly begins—on the asphalt, surrounded by flashing lights. Every photo is a brick in the foundation of your case. Start building. Our guide on what to do after a car accident has a more detailed checklist.

The Trick Insurance Companies Don’t Want You to Know

Let’s be brutally clear—the other driver’s insurance adjuster is not your friend. They are not a helper. They are a professional claim minimizer whose bonus depends on saving their company money—your money.

Their playbook is old, cynical, and ruthlessly effective. It starts with that first, disarmingly kind phone call. “We just want to get your side of the story,” they’ll coo. “Would you mind if I record this call for our records?”

Yes, you would mind. It’s a trap. It’s always a trap.

They Will Use Your Own Words Against You

A recorded statement is not a chat. It’s a deposition you’re not prepared for, a fishing expedition where they dangle tricky questions designed to get you to admit fault/downplay your injuries.

- "How are you today?" You say, “I’m okay, thanks,” out of politeness. They write: Claimant states injuries are not serious.

- "Can you tell me what happened?" They want you to guess at speeds/distances. Any tiny inconsistency with the police report will be used to call you a liar.

- "Were you on your phone?" A blatant attempt to shift blame.

The only winning move is not to play. You politely decline to give a recorded statement. Period. Many insurers use automated claims processing systems that flag these phrases instantly, digging you into a hole before you even know you're in one.

The Lowball Offer Is a Test of Your Desperation

Soon after, they’ll dangle a check for a few thousand dollars. An “early settlement offer.” They know you’re out of work, staring at your deductible. They are preying on your vulnerability.

That check is a fraction of what your claim is worth. Cashing it means you sign away your right to ever seek another penny—even if you need surgery a year from now.

If you don’t take the bait, they pivot to delay, deny, defend. Lost paperwork. Unreturned calls. Endless requests for the same form. The absolute worst insurance tactic is making you feel like your legitimate pain is just an inconvenience. It’s a war of attrition designed to grind you down until you take their garbage offer. Don’t fall for it. Check out our guide on why insurance companies deny claims to see the full playbook.

You Build Your Case with a Mountain of Proof

In the cold world of a car accident injury claim, your pain is just a rumor until you prove it. The sleepless nights, the anxiety that grips you behind the wheel, the agony of just trying to put on your shoes—to an adjuster, it’s all hot air.

We make it real. We build an undeniable, meticulously documented record of how this crash incinerated your normal life. This isn’t paperwork. This is ammunition.

Every Doctor’s Visit Is a Piece of Evidence

Your medical records are the bedrock of your claim. Insurers are experts at exploiting gaps. Wait a week to see a doctor? They’ll argue you weren’t really hurt. Miss a PT appointment? You clearly aren’t committed to getting better. It’s a cynical, infuriating game. We play it to win.

- Keep a Medical File. A binder/folder with every doctor’s summary, PT note, prescription receipt, and bill.

- Track Every Penny. Co-pays, mileage to appointments, crutches, medication. It adds up fast.

- Follow Doctor’s Orders. Go to every single appointment. If you must reschedule, call immediately and note the reason.

Your Pain Journal Is Your Most Powerful Weapon

This is the part everyone skips, and it’s often the most valuable piece of evidence we have. You need to document the invisible injuries—the daily pain, the emotional toll, the loss of your life’s simple joys.

A few bullet points each day in a notebook/your phone is all it takes.

- Pain Scale (1-10): Where does it hurt? What does it feel like—sharp, dull, throbbing?

- Daily Limits: What couldn’t you do today? “Couldn’t lift my kid.” “Couldn’t sit through a movie.” “Had to ask for help opening a jar.”

- Emotional Toll: Be honest. Anxiety, frustration, depression. “Had a panic attack in traffic.” “Cried today. Felt useless.”

- Life Interrupted: What did you miss? “Skipped my son’s soccer game.” “Canceled hike with friends.”

This transforms “pain and suffering” from a vague legal term into a concrete, day-by-day account of your reality. This is how we make them pay for what they took from you.

We Will Calculate the True Value of Your Claim

Insurance companies have a secret formula. It’s a cold, cynical algorithm that translates your broken bones and chronic pain into the smallest possible dollar amount. It’s garbage.

We have our own math—based on Colorado law, years in the trenches, and the brutal truth of what this wreck has cost you. We don’t play their game. We dictate the terms.

You Are Owed for More Than Just Your Bills

Legally, your compensation—your “damages”—falls into two buckets. The insurer wants you to focus only on the first. We make them fill both to the brim.

- Economic Damages: These are the black-and-white, receipt-based losses. Your past/future medical bills, lost wages from work, and your reduced ability to earn a living if your injuries are permanent.

- Non-Economic Damages: This is the human cost. This is the compensation for your physical pain, your emotional distress, your inability to do the things that made you you.

An adjuster will never voluntarily pay you for your sleepless nights or your inability to pick up your child. We make them. This category covers your pain and suffering, loss of enjoyment of life, and compensation for any permanent impairment/disfigurement.

The Math that Makes Insurers Pay Attention

So how do we put a number on suffering? The common method is using a multiplier. We total up your economic damages and multiply that by a number between 1.5 and 5, or even higher for catastrophic injuries.

A minor whiplash might be a 1.5x multiplier. A traumatic brain injury could be 5x or more. The strength of your documentation—your medical records and your pain journal—determines that number.

Industry data shows claim values are rising fast. By mid-2025, average bodily injury payouts are projected to hit $29,100—a 36% jump since 2020—while overall plaintiff recoveries average $52,900. Dive into the full Crash Course report detailing these trends to see why. We use this hard data to ensure our valuation isn’t just fair, it’s bulletproof. Learn more about how insurance companies calculate settlements and their dirty tricks here.

Your Claim Ends in Negotiation—Or a Lawsuit

After we’ve built the case and calculated the true value, we fire off a formal demand letter to the insurance company. It’s our opening shot. It lays out the facts, the evidence, and the number they need to pay.

Their first counteroffer is almost always a joke. We expect it. This is the start of the negotiation—a tense, strategic dance where we dismantle their arguments with the mountain of proof we’ve built.

This back-and-forth can take weeks/months. More than 95% of cases are resolved right here. But what happens when they refuse to be reasonable?

We File Suit When They Refuse to Be Fair

When the insurer draws a line in the sand with a final, insulting offer, we have a serious talk about filing a lawsuit. A “claim” is a request for payment. A “lawsuit” is dragging them into court to let a jury force them to pay.

Filing suit changes everything. The process of discovery begins, where we can legally demand their internal emails, adjuster’s notes, and company procedures. We conduct depositions, questioning the at-fault driver and witnesses under oath.

The credible threat of a trial is the most powerful leverage you have. We prepare every single case from day one as if it’s going before a jury. Suddenly, their “final” offer isn’t so final anymore. When the fight is on, choosing the right advocate is everything.

The Most Common Mistakes That Will Wreck Your Claim

It is shockingly easy to sabotage your own case. Insurance companies are counting on it. Think of this as the cheat sheet to their test. Avoiding these traps could be worth tens of thousands of dollars.

Believing Social Media is Your Friend

The second you file a claim, they are watching. That picture of you smiling at a BBQ is “proof” you aren’t in pain. Go completely dark on all social media until your case is over. Don’t post. Don’t comment. Nothing.

Ignoring the Clock

In Colorado, the statute of limitations for most car accidents is three years from the crash date. Miss it by one day, and your claim is worth zero. Forever. Insurers love to drag things out, hoping you’ll run out the clock. Don’t let them.

Gapping Your Medical Treatment

This is a killer. Any gap in your medical care is a gift to the insurer. They’ll argue your injuries weren’t that serious/you must have been reinjured somewhere else. Stick to your treatment plan like your life depends on it. Because your financial life does.

The most insidious insurance tactic is making you feel like your legitimate pain is just an inconvenience to them. They want you to make these mistakes. They’re counting on you to get tired and give up. We will not let that happen.

We Get These Questions All the Time

The legal world is full of confusing jargon. That’s by design. It benefits them, not you. Here are straight answers.

How Much Is My Claim Worth?

The honest answer: it depends. Anyone who gives you a number in the first meeting is selling snake oil. The true value is a complex mix of your medical bills, lost wages, and the human cost of your injuries. We can’t know the real number until you’ve reached Maximum Medical Improvement (MMI)—the point where you’re as healed as you’re going to get.

How Long Does a Car Accident Injury Claim Process Take?

Longer than you want. A simple case might take a few months. A complex case with serious injuries could easily take a year or more, especially if we have to file a lawsuit. Rushing to a quick settlement is the most expensive mistake you can make. Patience is a weapon.

Do I Have to Go to Court?

Probably not. Over 95% of cases settle. But we prepare every case for trial from day one. That readiness is what forces them to offer fair settlements. They know we don’t bluff.

How Do You Get Paid?

You don’t pay us a dime unless and until we win. We work on a contingency fee. We front all the costs of building your case. Our fee is a percentage of the money we recover for you. If we don’t win, you owe us nothing. It means our only goal is the same as yours: getting you the absolute maximum compensation you deserve.

Disclaimer: This blog post is for informational purposes only and does not constitute legal advice. The information provided is not a substitute for consulting with a qualified attorney. The specific facts of your case will determine the best course of action. No attorney-client relationship is formed by reading this post.

The insurance company has a team of lawyers. You need one, too.

Let’s talk. I’m here. I’ll handle the fight so you can focus on healing.

Call us at (720) 441-4235 or fill out our online form to schedule a free, no-obligation consultation. I’ll review your case myself.

Written by

Conduit Law

Personal injury attorney at Conduit Law, dedicated to helping Colorado accident victims get the compensation they deserve.

Learn more about our team