Table of Contents

Picture this. You’re in a brutal crash. A semi-truck swerved into your lane on I-70, and the world went sideways. Your case feels like a slam dunk, but you need one thing to nail it shut: the truck’s dashcam footage.

So we send a formal demand letter. Weeks later, their lawyer writes back, dripping with fake sympathy. “Regrettably,” the letter begins, “the requested footage was lost during a routine data purge.”

Just like that, the proof is gone. Your slam-dunk case feels like it’s evaporating. This is spoliation of evidence. It’s a dirty, calculated tactic where companies and their insurers make the proof of their negligence simply… disappear. They want you to think it’s bad luck. We know it’s a confession in disguise.

The Trick Insurance Companies Don’t Want You to Know

Let’s be clear—this isn’t an accident. It’s a strategy. It's a cold, calculated decision to make inconvenient facts vanish into thin air, betting you'll feel overwhelmed and just give up.

Their excuses are an art form of feigned incompetence—the conveniently timed "system error," a "misplaced" driver log, or crucial security footage that was "automatically overwritten" mere hours before we asked for it. They weaponize corporate policy, hoping you won’t see the pattern.

We see it. We’ve seen this playbook run a hundred times. And we know how to turn their attempt to hide the evidence into the most damning evidence of all.

So, what is spoliation of evidence, really? Let’s cut the legalese. It’s any action—or a deliberate failure to act—that results in relevant evidence being destroyed, altered, or hidden from your case.

It’s not always a villain shredding documents in a fireplace. It’s quieter, more bureaucratic, but the goal is the same: to rig the game by hiding the cards.

The “Duty to Preserve” Kicks In Immediately

This isn't a friendly suggestion—it's a legal command. The second a company or its insurer can reasonably anticipate a lawsuit is coming, a legal “duty to preserve” all relevant evidence automatically kicks in.

They don't get to wait for you to file a lawsuit. The clock starts ticking the moment they know—or should have known—a claim was on the horizon. From that second forward, destroying evidence isn’t an accident. It's a choice. A very, very bad one.

This duty covers everything you can imagine—and plenty you can't:

- Physical Objects: The wrecked semi-truck, the defective ladder, the broken sidewalk tile that caused your fall.

- Paper Documents: Driver logs, maintenance records, internal incident reports, employee files.

- Electronic Data: Emails, text messages, surveillance footage, GPS data, and "black box" data from vehicles.

The Digital Smoke Screen

Today, the real battlefield is digital. The proof is scattered across servers, hard drives, and the cloud—and it’s terrifyingly easy to make it all vanish with a few clicks.

Electronically stored information (ESI) is now at the center of most spoliation fights. A landmark study about spoliation trends in federal courts found that ESI was involved in a whopping 53% of all spoliation cases. In 40% of those cases, the only evidence that went missing was digital.

That "routine data purge" that wiped out the emails discussing a safety hazard? That's a strategy. That security footage that gets "overwritten" every 24 hours? That's a corporate policy designed to destroy evidence by default.

It makes no difference whether they dragged a file to the trash can themselves or let their automated systems do the dirty work for them. If they had a duty to save it and failed, that’s spoliation. And that's exactly where we turn their dirty tricks into our most powerful weapon.

The Playbook They Pray You Never Discover

Spoliation of evidence isn't an accident. It’s a strategy. A cold, calculated risk that corporations and their insurance carriers take, betting you won’t have a lawyer who knows how to call their cynical bluff.

They weaponize corporate policy and feigned incompetence to make critical evidence vanish into the ether. They have a whole playbook of plausible-sounding excuses designed to make you feel powerless. It's never bad luck. It's always a choice.

Their Favorite Excuses

Consider these infuriatingly common scenarios. Each one is a classic move from the corporate playbook, and we’ve heard them all.

- The crystal-clear slip-and-fall footage from the big-box store that was “automatically recorded over” after just 24 hours—a convenient “system setting” they fail to mention until it’s too late.

- The truck driver’s logbooks—the ones that would prove he was driving over his legal hours—that were mysteriously “misplaced” during a routine office move.

- The internal company emails about a dangerously defective product that were deleted as part of a “routine data purge,” wiping the slate clean just before a lawsuit was filed.

They will look you in the eye—or more likely, have their lawyer write a sterile letter—and claim it was an accident. They will absolutely pray you believe them. The excuses are endless, but the goal is singular: to destroy the proof of their wrongdoing.

Their act of destroying evidence isn't just an attempt to obstruct justice—it's a confession. They wouldn't bother hiding the evidence if it proved they were innocent.

Why They Think They Can Get Away With It

This isn't carelessness. It's a cost-benefit analysis. The insurer's lawyers know that proving spoliation is a fight. It takes time, money, and a deep understanding of digital forensics. They are betting that your lawyer—if you even have one yet—won’t have the resources or the grit to take them on.

They are betting you'll hear "the footage was deleted" and think, "Well, there goes my case." This is precisely where a lawyer who specializes in these fights can turn the tables completely. Their attempt to hide the ball becomes the entire game. And it's a game they're about to lose.

An insurance company’s duty to preserve evidence kicks in the moment they anticipate litigation. Failing to do so—whether through intentional destruction or simple negligence—is a serious violation. This legal duty isn't a suggestion. It's an obligation. The moment they break it, they open themselves up to severe penalties from the court.

If you've been injured and suspect evidence is missing, it’s critical to act fast—even if you don't have a police report yet. You might be interested in our guide on how to make an insurance claim without a police report, which can help.

The bottom line is that their excuses are just a smoke screen. A skilled attorney knows how to blow that smoke away and expose the fire of liability burning underneath.

How We Make Evidence Destroyers Pay for Their Sins

When a company destroys evidence, they aren't just bending the rules—they're confessing. They're making a cold, calculated bet that the penalty for getting caught is less damaging than what the evidence itself would prove.

It's a cynical gamble. But Colorado judges are fully prepared to shut it down. The law gives us a powerful set of tools, known as sanctions, to punish the spoliator and level the playing field. This isn’t a slap on the wrist. It’s a strategic countermove that can completely change your case.

Judges do not take kindly to being lied to. When one side tries to win by cheating, courts can impose penalties that range from painful to catastrophic. This is where we turn their dirty trick into our greatest advantage.

The Court's Arsenal

The specific remedy a judge chooses depends on how egregious the act was. Our job is to prove their level of fault—was it simple negligence, gross negligence, or intentional bad faith? We also have to show the court exactly how the loss of that evidence cripples your ability to prove your case.

Once we lay that foundation, we ask the court to bring the hammer down. These aren't abstract theories—they are weapons we use to hold evidence destroyers accountable.

Here are the most common sanctions we pursue:

- Monetary Fines: The court can order the spoliator to pay for all the attorney's fees and costs we racked up proving they destroyed the evidence. It makes them pay, literally, for their misconduct.

- Evidence Preclusion: The judge can prohibit them from using certain evidence or making specific arguments. If they destroyed a truck’s maintenance logs, the judge might forbid them from arguing the truck was well-maintained.

The Nuclear Options

In more serious cases, the sanctions become even more severe. These are the penalties that keep corporate defense lawyers up at night.

Adverse Inference Instruction: This is the big one. The judge formally instructs the jury that they are allowed to assume—or infer—that the evidence the defendant destroyed would have been harmful to their case. This is often a fatal blow, as it's essentially the court telling the jury, “You can assume they’re hiding something damning.”

In the most extreme cases, a judge can deploy the ultimate sanction:

Default Judgment: This is the knockout punch. The court strikes the defendant's entire defense from the record and grants a judgment in your favor. Game over. You win. This is reserved for the worst offenders.

When a party destroys evidence, Colorado courts can impose various sanctions to punish the wrongdoer and level the playing field. The severity of the sanction often depends on the culpability of the party and the prejudice caused to the innocent party.

Potential Sanctions for Spoliation in Colorado

| Sanction Type | What It Means for Your Case | When It's Typically Used |

|---|---|---|

| Monetary Fines | The other side has to pay for the legal work needed to prove they destroyed evidence. | Common in cases of negligence where the financial cost of the spoliation can be calculated. |

| Evidence Preclusion | The wrongdoer is barred from making arguments that the destroyed evidence could have refuted. | Used when destruction was negligent or reckless and directly impacts a key element of the case. |

| Adverse Inference | The judge tells the jury they can assume the missing evidence was bad for the other side. | Reserved for cases of gross negligence or intentional destruction where the evidence was crucial. |

| Default Judgment | The ultimate penalty. The court strikes the defendant's case entirely and rules in your favor. | Used only in the most extreme cases of bad-faith, intentional destruction meant to subvert justice. |

These sanctions are designed to ensure that cheating doesn't pay.

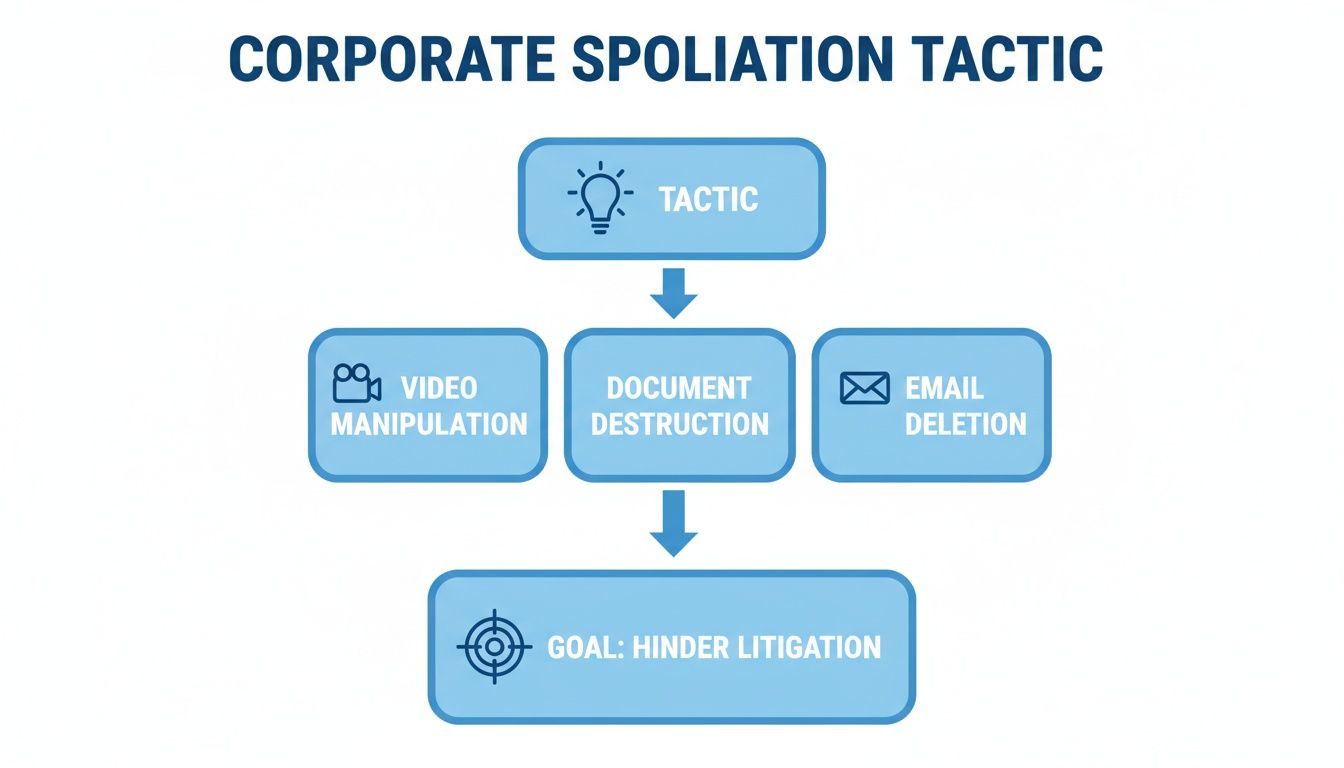

The flowchart below breaks down the typical corporate spoliation playbook—from deleting digital files to shredding physical records—all aimed at derailing your pursuit of justice.

Securing these sanctions is a serious fight. One study found that motions for sanctions were granted in only 18% of the cases reviewed. This highlights just how heavy the burden of proof is—and why skilled representation is essential. You can read more about these findings and notable cases in eDiscovery.

Winning a spoliation motion requires more than just pointing out that evidence is missing. It requires a meticulous investigation to build a case about the missing evidence to convince a judge that a penalty isn't just appropriate, but necessary.

The Blueprint for Making the Truth Stick

You cannot—and I mean cannot—leave evidence preservation to chance. The other side is already operating from a playbook designed to make proof disappear. You have to be faster, smarter, and more aggressive.

Fighting back against potential spoliation of evidence means building a fortress around the truth of your case from the second you’re injured. This isn’t passive. It’s an immediate action plan.

The First 24 Hours: Your Action Plan

Time is your enemy. Evidence is fragile. Digital data gets overwritten on automated schedules, physical objects get moved or repaired, and witness memories fade. The clock starts ticking now.

Your goal is to officially notify every potential defendant that their legal duty to preserve evidence has begun—and to document everything before it has a chance to vanish.

Here is the essential, non-negotiable checklist:

- Send an Immediate Preservation Letter: This is the opening shot. It’s a formal legal notice—sent by your attorney—demanding that the at-fault party and their insurer preserve all relevant evidence. It must be specific, broad, and undeniable.

- Document Everything: Become your own forensic investigator. Use your phone. Take hundreds of photos and videos of the scene, your injuries, the vehicle damage, and anything else that seems remotely relevant. You can never have too much.

- Identify All Evidence Sources: Think beyond the obvious. Are there nearby businesses with security cameras? Did bystanders record the aftermath on their phones? Does the truck that hit you have a "black box" data recorder? Make a list.

- Act Without Delay: This is the most critical step. Every other action depends on speed. The single most important thing you can do is engage an attorney who can immediately fire off preservation letters and dispatch investigators.

This isn't just about collecting evidence—it's about preventing its destruction. The other side has systems in place to get rid of inconvenient facts. Your immediate action is the only thing that can stop that process.

Broadening Your Investigative Net

Thinking creatively about where evidence hides is crucial. In a slip-and-fall at a big-box store, you need more than the video of the fall. You need to demand the things they don't want you to see—like store inspection logs, employee schedules, and maintenance records.

As you can learn from our guide on securing surveillance footage after an injury at King Soopers or Safeway, these documents can be even more powerful than a video. They can prove a pattern of negligence the company would prefer to keep hidden.

By taking these steps, you build a wall around the truth, making it infinitely harder for an insurer to claim the proof of their negligence simply—and conveniently—vanished.

Why You Need a Specialist to Fight Spoliation

Proving that evidence was deliberately destroyed isn't a task for a general practitioner who dabbles in personal injury. This is a high-stakes, bare-knuckle brawl that demands a very specific skill set.

The legal bar for convincing a judge to issue sanctions is incredibly high. You have to build a complete case-within-a-case, proving the at-fault party's culpability—was it simple negligence, gross negligence, or intentional bad faith? Then you must show exactly how the absence of that evidence guts your ability to prove your claim. It’s a full-blown investigation.

Unearthing What They Tried to Bury

This fight means digging deep into the other side's data retention policies, putting their IT staff under oath, and hiring digital forensic experts to find the ghosts in the machine. It’s about reverse-engineering their cover-up. You can bet they have a team of corporate lawyers paid by the hour to justify their client’s “mistakes” and bury you in procedural nonsense.

They will argue their actions were “routine.” They will file motion after motion to block your attempts to get to the facts. They are banking on outspending you.

You need a litigator who lives for this exact fight—someone who knows precisely how to corner a corporate defendant and expose their excuses for the lies they are. This is a specialist’s game.

The complexity is amplified because the rules aren't uniform. The standards for spoliation sanctions can vary wildly between court systems. This patchwork of rules underscores why you need a lawyer deeply familiar with the specific standards that apply to your case.

This Is a Fight of Inches

Successfully proving spoliation of evidence requires a lawyer who can:

- Draft an ironclad preservation letter that leaves no room for excuses.

- Conduct aggressive discovery to expose internal policies and communications.

- Depose corporate representatives and IT staff with surgical precision.

- Work with forensic experts to recover deleted data or prove protocols were violated.

- Write a compelling legal brief to convince a skeptical judge that sanctions are necessary.

This is what we do. When an insurance company tries to cheat by hiding evidence—whether it’s in a catastrophic trucking crash or any other serious injury case—we don’t just get mad. We get to work. As you can see in our guide on handling a fatal truck accident on I-25, the evidence is everything. We know how to unearth what they tried so hard to hide.

Common Questions About Spoliation of Evidence

It’s bad enough dealing with a serious injury. But learning the company responsible might be destroying the very proof you need? That’s adding a whole new level of insult. The legal concept of spoliation of evidence can feel complicated, so let's cut through the noise.

Think of this as your field guide for when the other side tries to hide the truth.

What If the Evidence Was Destroyed Accidentally?

"Oops, it was an accident." This is, without a doubt, the number one excuse we hear. But here’s the thing: even if the destruction was just careless instead of malicious, a judge can still bring down powerful sanctions. What truly matters is whether the other party had a legal duty to preserve that evidence when it vanished.

The law isn’t just looking at their intent. It’s trying to fix the fundamental unfairness that the loss of evidence creates for your case. If their negligence robs you of your ability to prove what happened, the court can—and should—step in.

How Quickly Must I Act to Prevent Spoliation?

Immediately. Yesterday would have been better. There is absolutely no time to waste here. Big companies often have automated data destruction policies that can permanently delete crucial electronic evidence—think emails or security footage—in a matter of days, sometimes even hours. The single most critical first step is to get a formal preservation letter in their hands to stop that clock.

Can I Sue Someone Just for Destroying Evidence?

In most cases, no—at least not as a completely separate lawsuit. Spoliation is an issue that's handled through sanctions within your personal injury case. It's a powerful tool we use in the main fight, not a separate legal battle. Colorado law does recognize a separate claim for fraudulent concealment in truly rare and extreme situations, but that’s a very high bar to clear.

What Kind of Proof Counts as Evidence?

Just about anything that could be relevant to proving what happened. It’s an incredibly broad category, and we're not just talking about some single "smoking gun" document.

You have to think bigger, and you have to think digitally. Evidence can be any of the following, and much more:

- Emails and internal company memos

- Text messages and voicemails

- Photos and video footage from any source

- GPS and telematics data from commercial trucks

- Vehicle "black box" data recorders

- Maintenance logs and inspection reports

- Driver qualification files and other personnel records

- The actual physical items involved—like the wrecked truck or the defective product itself.

The other side has a duty to hang onto all of it. Our job is to hold them to it.

Disclaimer: This blog post is for informational purposes only and does not constitute legal advice. Reading this post does not create an attorney-client relationship. Every case is unique, and you should consult with a qualified attorney to discuss the specifics of your situation.

If you think an insurance company is playing games with the evidence in your case, let’s talk. The consultation is free, the advice is straightforward, and the pressure is zero. I got you.

Written by

Conduit Law

Personal injury attorney at Conduit Law, dedicated to helping Colorado accident victims get the compensation they deserve.

Learn more about our team