Table of Contents

It’s the question that echoes in the dead of night, right after the panic about the medical bills subsides—how long does an insurance company have to settle a claim?

The State of Colorado has an answer, written down in black-and-white statutes. We’ll get to that. But the real answer—the one whispered between adjusters in cubicles from Pueblo to Fort Collins—is far more cynical: as long as they can possibly get away with it.

The waiting isn’t a bug in the system. It’s the entire point. The endless hold music, the unreturned emails, the vague promises that evaporate the second you hang up the phone—it’s all a meticulously crafted performance designed to do one thing: wear you down. They want you so tired, so frustrated, so financially desperate that you’ll snatch at the first insulting, lowball offer they slide across the table.

This isn't just business. It's a war of attrition. And they have all the time—and all the money—in the world. This is your counter-offensive.

The Waiting Game Is Their Winning Strategy

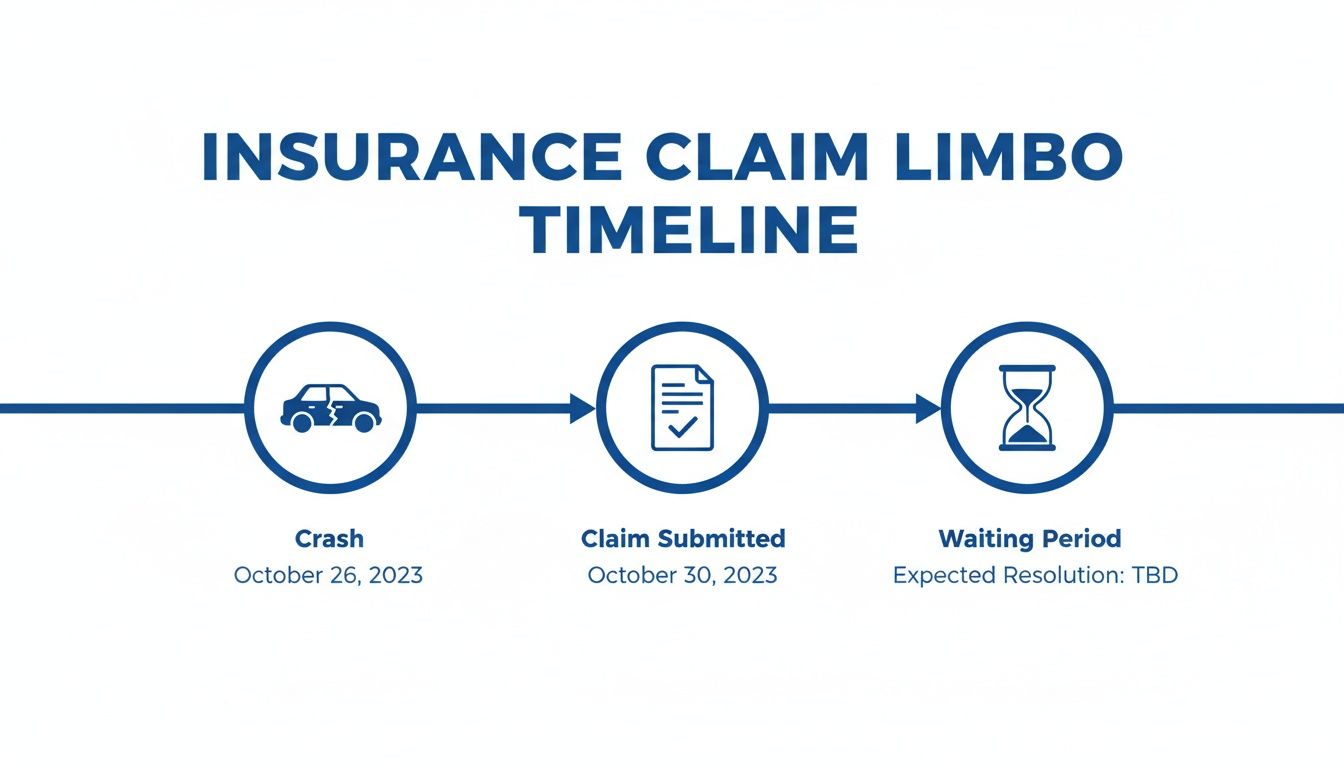

It always starts with a crash—a moment of screeching tires and shattering glass that splits your life into a Before and an After.

You did everything right. You filed the police report. You went to the doctor. You called the insurance company, armed with your policy number and a naive belief that they were there to help. And now, you wait. You’re trapped in a special kind of hell, a bureaucratic limbo where days bleed into weeks, and your polite inquiries are met with a maddeningly cheerful, “We’re still investigating.”

This isn’t just bad customer service—it's a calculated strategy. The insurance industry’s entire business model is built on a simple, brutal principle: the longer they hold onto their money, the more money they make. They are literally profiting from your pain, earning interest on the settlement that should be paying your rent.

They are counting on you to get desperate. Desperate people make mistakes. Desperate people accept insulting lowball offers.

Let’s be clear—this is a deliberate tactic. They want to exhaust you. They want to bury you in paperwork. They want the pressure to build until you break. But knowing the game is the first step toward beating them at it.

The Deadlines They Pray You Never Learn

Insurance companies operate in a world of complex legalese and fine print—a world where they wrote most of the rules. But Colorado law has its own rulebook, a little thing called the Unfair Claims Practices Act (UCPA).

This law sets the absolute bare minimum for how an insurer must behave. They want you to believe the claims process is a mysterious black box. It’s not. There are actual clocks ticking, and knowing the deadlines is your first, best weapon.

This timeline is the journey they force you on—from the shock of the crash into that agonizing limbo where they hold all the cards.

That "waiting period" is where they make their money. It's where your urgent need for recovery becomes their opportunity for profit.

The Clock Is Ticking—Legally

Under Colorado law, insurers can’t just let your claim gather dust. Once you’ve put them on notice—which you should do immediately, as we detail in our guide on how long you have to report an accident to insurance—the ball is in their court. They have legal duties.

These aren’t suggestions. They are legal obligations.

| Insurer Action | Legal Deadline | What This Means for You |

|---|---|---|

| Acknowledge Your Claim | 10 working days | They must confirm receipt and give you a claim number. Period. |

| Respond to Communications | 10 working days | Your calls/emails cannot go into a black hole. They must reply. |

| Provide Claim Forms/Instructions | 15 working days | They must send you the necessary paperwork and explain the process. |

| Pay Undisputed Benefits | 30 days | If part of your claim is obvious—like a specific ER bill—they must pay it now. |

| Accept/Deny the Claim | 60 days | After they have what they need, they have two months to make a decision. |

These deadlines look great on paper, don’t they? But there’s a loophole big enough to drive a semi-truck through.

The Trick Is the Word "Reasonable"

The law requires a “prompt” or “reasonable” investigation. And what, exactly, does “reasonable” mean? To you, it means they review the police report and your medical records, then cut a check.

To them, “reasonable” means whatever they need it to mean on any given Tuesday. It’s an infinitely stretchable concept they exploit to justify absurd delays. Suddenly, a “reasonable” investigation involves:

- Endless document requests for things you’ve already sent twice.

- Demands for recorded statements designed to trick you.

- Waiting for obscure records that have zero bearing on your case.

This is how legal deadlines become mere suggestions. They’ll stall for months, hiding behind the shield of “we’re still investigating.” They exploit the ambiguity of the word "reasonable" to justify unreasonable delays. It’s a cynical, calculated game—and now you see it for what it is.

The Playbook of Delay, Deny, Defend

If your claim is going nowhere, it’s not an accident. It’s a strategy—a playbook perfected over decades to frustrate, exhaust, and demoralize you into submission.

Insurance companies didn’t build those glittering downtown skyscrapers by promptly paying what they owe. They built them by mastering the art of the stall. The goal is to make the process so agonizingly painful that you’ll either accept a pittance to make it stop or just give up entirely.

The Never-Ending Paper Chase

The classic. The go-to. The adjuster will bury you in requests for documentation—every medical bill, every pay stub, every physical therapy note. You send it all, thinking you’ve finally satisfied them. A week later, another email lands: “We seem to have misplaced the discharge summary from your ER visit.”

This isn’t incompetence. It’s friction, deliberately created to wear you out.

The worst version is the unreasonable request for documentation. They’ll ask for your high school transcripts or your third-grade report card—anything they know is irrelevant or impossible to find, just to add another hurdle.

The Adjuster Shuffle

Notice how you’re suddenly talking to a new adjuster? For the third time? This isn’t a coincidence—it’s a tactic. Your file gets passed around like a hot potato, and every time it lands on a new desk, the clock resets.

The new adjuster, “Brian,” needs to get “up to speed.” He hasn’t had a chance to “fully review the file.” He has no idea what the last adjuster, “Karen,” told you. It’s a brilliant, infuriating system for destroying momentum and ensuring no one is ever held accountable.

The So-Called “Independent” Medical Exam

This is one of the most sinister plays. The insurer may demand you see their doctor for an “Independent Medical Exam” (IME). Let’s be crystal clear: there is nothing “independent” about it.

These are hired guns—doctors who make a fortune writing reports that serve the insurance company’s interests. Their job isn’t to heal you; it’s to find any excuse to minimize your injuries. Your herniated disc? A pre-existing condition. Your chronic pain? You’re exaggerating. Their report becomes the “proof” the insurer needs to slash your settlement.

The Lowball Offer with the Fake Deadline

After months of silence, an offer finally arrives. It’s an insult—a number that wouldn’t even cover your co-pays. But it comes with a string attached: “This offer is only good for 48 hours.”

They want you to panic. They want you to feel the squeeze of your mounting bills and make a rash decision. Recognizing this tactic for what it is—part of a larger strategy—is essential.

Remember: the first offer is never the best offer. It’s a test. When you see these moves—especially the unreasonable request for documentation—you know you're in a fight. It's not a negotiation. It's a fight. See our guide on why insurance companies deny valid claims for more.

The Cold, Hard Numbers Behind the Delay

That feeling in the pit of your stomach—that this is taking way too long—isn’t paranoia. It’s reality. You are a single data point in a massive, industry-wide strategy where delay is the entire business model.

Insurers have a million excuses. But the numbers tell a simpler, colder story: they are sacrificing your well-being for their bottom line. Every day they delay your payment is another day your money works for them, not you. Once you see the statistics, you realize your claim isn't an anomaly. It's the system working exactly as designed.

The Numbers Don't Lie

Industry studies from groups like J.D. Power confirm what you already feel: claim resolution times are getting longer, and customer satisfaction is cratering right along with it. This is not a coincidence.

The time just to get a vehicle repaired has ballooned to over 22 days. For more complex injury claims, the delays are even worse.

What this really means is that the insurance industry is deliberately slowing down. They have made a calculated decision that the profit from delaying claims outweighs the risk of upsetting customers.

They are quite literally profiting from your pain.

The Real Reason for the Delays

So why is this happening? It’s not because claims got more complicated. It's because insurers have crunched the numbers and figured out the average person's breaking point.

It’s a pressure cooker strategy. By cranking up the financial and emotional heat through endless delays, they know they can force you into accepting a lowball offer just to make the nightmare end.

Here’s the cold math they’re running:

- Financial Duress: The longer they wait, the more your bills pile up. Desperation mounts.

- Emotional Exhaustion: Fighting a corporation is a full-time job you never asked for. They know you will get tired.

- Reduced Payouts: A person under extreme pressure is far more likely to accept 50 cents on the dollar.

Every tactic, from the adjuster shuffle to the unreasonable requests for documentation, is a tool to push you closer to that breaking point. They are playing a numbers game where your suffering is just a variable on a spreadsheet.

How You Fight Back and Win

Okay, you see the game. You recognize the plays. Now it's time to flip the board over.

Waiting around for the adjuster to have a sudden change of heart is exactly what they want you to do. It’s time to go on offense. You can’t control their cynical playbook, but you can control your response. This is about creating a record, applying pressure, and showing them you aren’t the easy target they hoped for.

Here are the concrete steps to take back control.

Rule #1: Everything in Writing

From this moment on, stop relying on phone calls. An adjuster’s verbal promise is worth less than the air it’s spoken into. Your new mantra is simple: if it’s not in writing, it never happened.

After every phone call, send a polite, firm follow-up email. “Hi Brian, just to confirm our call, you stated you would have a response to my demand by this Friday. I’ll look for your email then.” This creates a paper trail they cannot deny. It builds your case, piece by piece.

Formally Demand Answers

When they miss a deadline—one of theirs or one of Colorado’s—don’t let it slide. Send a formal letter/email demanding an explanation.

Keep it professional, but direct. “You received the requested records on March 15th. It is now April 30th. Please provide a specific reason for this delay and a firm date by which I can expect a decision.” This shows you’re watching, and you’re keeping score.

Send a Professional Demand Letter

A formal demand letter is how you officially start the fight. This isn't just a letter—it's a comprehensive package that lays out the facts, details your injuries, itemizes every single dollar of your damages, and culminates in a specific monetary demand to settle the case.

A powerful demand letter signals that you are organized, you are serious, and you know what your claim is worth. It forces them to stop stalling and start negotiating.

Your Ultimate Weapon: The Statute of Limitations

This is the deadline that matters most. In Colorado, you generally have a three-year window from the date of the crash to file a lawsuit. This is called the statute of limitations.

The insurance company knows this date to the second. They will happily drag things out, hoping you’ll lose track and blow it. Once that date passes, your claim is worth exactly zero.

This deadline is your leverage. As it approaches, the threat of a lawsuit—and the massive expense it represents for them—becomes very real. It’s often the only thing that makes them finally settle.

When to Call an Attorney for Your Insurance Claim

Fighting an insurance company is an exhausting, lonely battle. They designed it that way. You’re trying to heal while playing chess against a grandmaster who owns the board and wrote the rules.It’s not a fair fight. But hiring an attorney is the great equalizer. It’s about leveling a playing field that was deliberately tilted against you from day one.

The Red Flags That Mean It's Time

You need to recognize the signals that they have zero intention of treating you fairly. These are the big ones:

- The Insulting Lowball Offer: They offer you less than your medical bills. This isn’t a negotiation tactic; it’s a slap in the face.

- They Deny Your Claim: They invent a reason—any reason—to pay you nothing. The time for talking is over.

- They Ghost You: The adjuster simply stops returning your calls/emails. This is a deliberate strategy to make you give up.

- You Have Serious Injuries: If you’re facing surgery, long-term care, or permanent impairment, the stakes are too high to go it alone. They will fight you every step of the way.

How a Lawyer Changes the Entire Game

Hiring a lawyer fundamentally alters the power dynamic. The adjuster can no longer bully/ignore you. All communication now goes through a professional who knows every trick in their playbook.

An attorney takes the vague threat of a lawsuit and makes it a credible, immediate reality. That—and only that—is the leverage that forces an insurer to pay what they truly owe.

This isn’t just anecdotal. Accenture research confirms that slow settlements are a huge driver of customer dissatisfaction, with 60% of unhappy claimants citing delays as a major issue, putting billions at risk. See the findings on insurance industry risks for yourself.

Making sure your side is heard is everything. It's about getting respect.

Your Questions on Claim Timelines—Answered

You know the playbook. You know the tactics. But you still have questions. Let’s get to them.

What Happens If an Insurer Misses a Legal Deadline in Colorado?

When an insurance company misses a legal deadline without a very good, documented reason, it’s evidence of an unreasonable delay. This is a powerful tool.

You can and should report them to the Colorado Division of Insurance. But the fastest way to get their attention is a letter from an attorney pointing out their failure. It tells them the game has changed—you know your rights, and you’re prepared to enforce them.

Can I Sue an Insurance Company for Taking Too Long?

Yes. In Colorado, you can file a lawsuit for an "unreasonable delay or denial" of benefits. This is a separate claim from your personal injury case against the at-fault driver.

To win, you must prove the insurer had no reasonable basis for the delay. It’s a high bar, but the mere act of filing such a lawsuit often forces them to the table with a serious offer. For more on this, read our guide on how long an injury settlement takes in Colorado.

Do These Rules Also Apply to My Own Insurance Company?

Yes—and this is critical. The Colorado Unfair Claims Practices Act applies to all insurers, including your own.

If you’re making a claim for your MedPay or Uninsured/Underinsured Motorist (UM/UIM) benefits, your own company has a legal and contractual duty to treat you fairly. When they don’t, they are breaking the law and betraying the trust you placed in them.

You've been patient long enough. If you’re tired of the excuses and ready for answers, let’s talk. The consultation is always free, and you don’t pay us a thing unless we win your case. I got you.

Call Conduit Law anytime at (303) 848-0240.

Disclaimer: This blog post is for informational purposes only and does not constitute legal advice. No attorney-client relationship is formed by reading this post. If you need legal assistance, please contact a qualified attorney.

Written by

Conduit Law

Personal injury attorney at Conduit Law, dedicated to helping Colorado accident victims get the compensation they deserve.

Learn more about our team