Table of Contents

The app told you the Toyota Camry was three minutes away. You hopped in the back, popped in your earbuds, and trusted a stranger to get you across town safely.

Then came the sickening crunch of metal—the world spinning sideways before a violent, sudden stop. Now your ears are ringing, your shoulder is on fire, and some chipper insurance adjuster is already leaving you a voicemail.

Let's cut through the chaos. As a passenger, your Uber accident passenger rights in Colorado are incredibly strong—because the law sees you as the one truly innocent party in the wreckage. You are 0% at fault, and that single fact unlocks a multi-million-dollar commercial insurance policy designed for this exact nightmare.

Your Power Is Being the Innocent Passenger

Let’s get one thing straight—you did nothing wrong. You were just along for the ride. That simple truth puts you in the most powerful legal position imaginable after a crash.

While the drivers and their insurance companies gear up to blame each other, you stand apart. This isn’t just a small advantage—it’s a massive tactical upper hand.

It gives you the right to pursue compensation from the Uber driver's policy, the other driver's policy, and Uber's mandatory safety-net coverage. We’re not talking about some flimsy personal auto plan—we’re targeting the substantial corporate policies Uber is legally required to carry.

The Trick Is Unlocking Uber’s $1 Million Commercial Policy

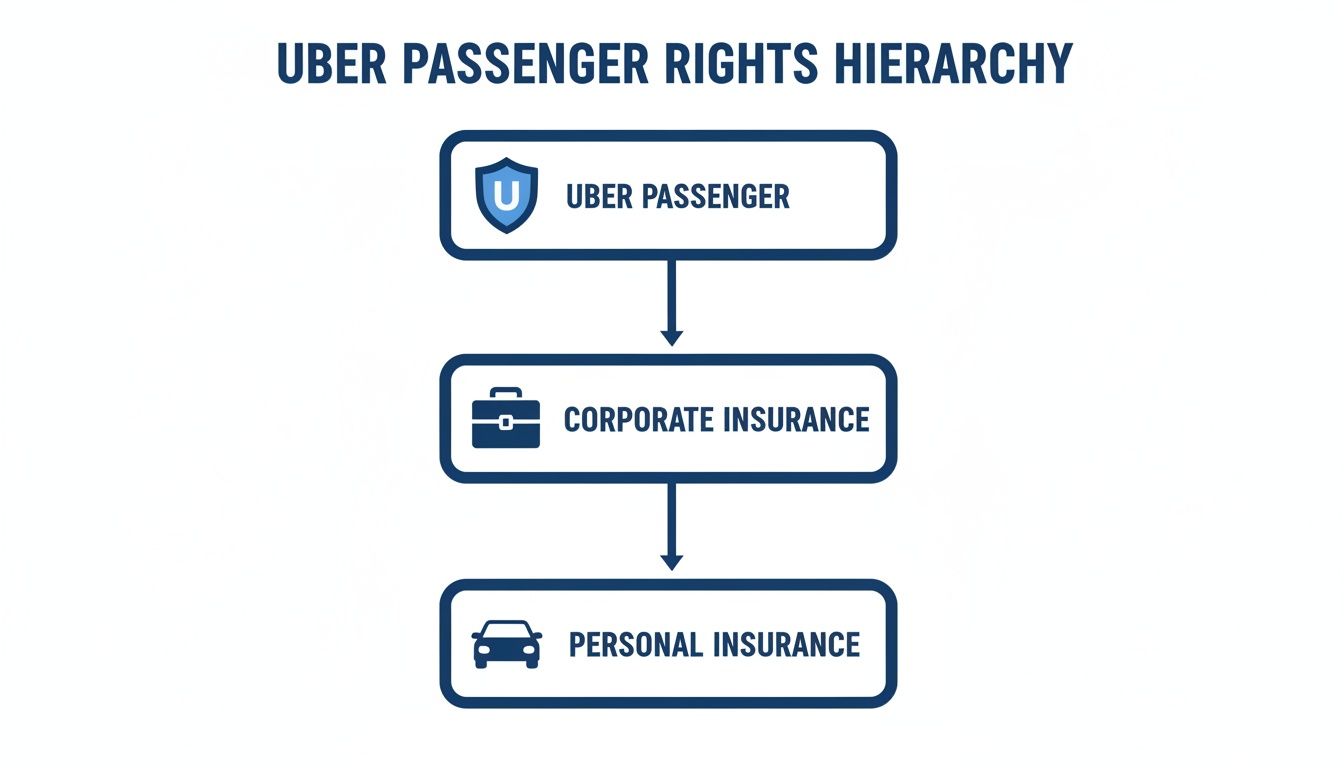

Uber’s insurance system is a deliberately confusing three-tier maze. It’s designed to limit their payout and frustrate victims into giving up.

Good news for you—as a passenger, you get to skip the maze entirely.

Your claim goes straight to the top. This simple hierarchy is your golden ticket, placing you directly under the protection of Uber's massive corporate policy and letting you bypass the driver's tiny personal insurance.

The Three Tiers—And Why Only One Matters to You

The moment your driver accepts the trip, you are automatically covered by the highest level of protection—Tier 3. It stays active from the second they head your way until the moment the trip ends.

- Tier 1: App Off. The driver is using their car for personal reasons. Their personal insurance applies. This does not cover you.

- Tier 2: App On, Waiting for a Ride. The driver is logged in but hasn't accepted your trip. Limited liability coverage applies ($50k/$100k). This does not cover you.

- Tier 3: Ride Accepted/In Progress. The driver accepted your trip/is en route/you are in the car. This triggers the full $1 Million commercial liability and UM/UIM policy. This is your shield.

That $1 million policy is the one we target. It’s the one insurance adjusters hope you don’t fully understand—or know how to access.

Your First Move: Prove You Were on an Active Ride

An insurance company's goal is to pay as little as possible. Their go-to move is claiming the driver wasn't technically "on the clock" to bump your claim down to a lower, less valuable insurance tier.

This is why the single most important thing you can do after a crash is prove you were in the middle of an active ride.

Your phone holds the key. A simple screenshot of your Uber app—showing the driver's name, the vehicle, and the active trip status—is the undeniable proof needed to lock in your claim under the $1 million Tier 3 policy. It shuts down their favorite argument before they can even make it, especially when a crash happens during a chaotic Denver winter storm.

The Path to Recovery When Your Uber Driver is At Fault

Let’s say your Uber driver was texting, speeding, or made an illegal turn that ended in a violent crash. The path forward for you is direct—and surprisingly powerful.

You aren’t going after the driver’s tiny personal policy. That’s a dead end. Because they were driving for a multi-billion-dollar company, your claim is made directly against Uber's $1 million commercial liability insurance policy.

This massive policy is required by Colorado law for one reason—to cover catastrophic injuries and make you whole again. It’s built to pay for everything that was taken from you.

What the $1 Million Policy Actually Covers

This isn't just for the first ER bill. It’s designed to cover the full, devastating scope of what you've lost—past, present, and future.

- Medical Bills: From the ambulance ride to future surgeries and physical therapy.

- Lost Wages: Every paycheck you missed while recovering—and compensation if you can’t return to your old job.

- Pain and Suffering: The human cost of the trauma—the chronic pain, the anxiety, the shattered quality of life. This is often the largest part of a serious injury claim.

The insurance company’s entire business model revolves around minimizing this payout. They will argue their driver wasn't at fault or that your injuries aren't that bad. It's their job. Our job is to build a case so strong it leaves them no room to argue.

Never, ever give a recorded statement. They will sound friendly, express sympathy, and then use every word you say to devalue your claim. The rideshare industry's own safety reports are grim—between 2021 and 2022, there were 153 fatalities in crashes involving their vehicles. You can read the full report on Uber accident data for more details. When your driver's mistake leads to a high-stakes outcome like a T-bone car accident settlement in Colorado, you need an ironclad case.

The Path When Another Driver Hits Your Uber

Now, let's say your Uber driver was a total pro—but some other car blew a stop sign and slammed into you. The at-fault driver's insurance is our first target.

But what if they only have Colorado’s laughably low state-minimum coverage of $25,000? Or worse, what if they have no insurance at all?

For most people, this is a financial disaster. For you, it’s where your Uber accident passenger rights in Colorado provide a crucial safety net.

Uber's $200,000 UM/UIM Safety Net Is Your Ace in the Hole

Thanks to a recent Colorado law (HB 22-1089), Uber must carry at least $200,000 in Uninsured/Underinsured Motorist (UM/UIM) coverage for you, the passenger. Think of it as a powerful, built-in insurance policy designed to protect you when the at-fault driver can't pay.

This law is a game-changer. When the other driver's policy runs out, we don't hit a dead end. We pivot and open a second claim against Uber’s own UM/UIM policy.

- The Uninsured Driver: Someone with no insurance hits your Uber. We file a claim against Uber’s $200,000 UM policy to cover your medical care and lost income.

- The Underinsured Driver: The at-fault driver has a tiny $25,000 policy, but your bills are $100,000. We take their full $25,000, then immediately file an underinsured motorist claim against Uber’s policy to recover the remaining $75,000.

As a Denver uninsured motorist lawyer, I see this as a chance to build a comprehensive claim that pulls from every available insurance policy. They want you to see this as a confusing mess. We see it as an opportunity.

Insurance Companies Only Have One Move Against You

Your legal position is rock-solid. You did nothing wrong. So the insurance company has only one play—a predictable and pathetic defense called comparative negligence.

They will try to coax you into admitting you somehow played a part in the crash. Did you talk on your phone? Ask to change the music? They'll claim you distracted the driver.

It sounds ridiculous because it is. But under Colorado law, if they can pin even 1% of the fault on you, they get to reduce your settlement by that much.

They will dig for any excuse to pin even 1% of the fault on you. This is their only play, and we see it coming from a mile away. It's why their first move is always to get you into a recorded statement—it’s a hunt for anything they can twist against you. Understanding the cynical reasons why insurance companies deny claims is the first step in beating them. Our job is to build a fortress of evidence around your 0% fault status and make that foolish legal maneuver impossible.

Your Immediate Next Steps to Secure the Claim

The moments after a crash are a blur. Taking a few calm, deliberate actions right now can mean the difference between a fair settlement and a financial nightmare.

First, your health is everything. But second, you must protect your rights.

Lock It Down: Evidence and Medical Care

- Screenshot the Ride. Pull out your phone and screenshot the active Uber trip. This one action locks you into the $1 million commercial policy.

- Call 911. Insist on an official police report. It’s a critical piece of evidence documenting who, what, where, and when.

- Get Medical Attention. Now. Go to an ER/urgent care, even if you feel fine. Adrenaline masks serious injuries. A medical record creates a timestamped link between the crash and your injuries that is essential for your claim.

- Do Not Talk to Insurance. Soon, an adjuster will call. They will sound friendly. Their only job is to get you into a recorded statement to trick you into downplaying your injuries. Hang up.

Your first and only call should be to an attorney who lives and breathes this complex world. Protecting your Uber accident passenger rights in Colorado starts by getting an experienced Denver Uber & Lyft accident lawyer in your corner from day one. Let us handle the adjusters. Your only job is to get better.

The content of this website is for informational purposes only and does not constitute legal advice. No attorney-client relationship is formed by viewing this site or submitting an inquiry.

When you're ready, the call is free. We'll listen to what happened, and we'll tell you how we can help. No pressure, no nonsense. I got you.

Conduit Law is ready to protect your rights. Schedule your free, no-obligation case evaluation with us today by visiting us at https://conduit.law.

Written by

Conduit Law

Personal injury attorney at Conduit Law, dedicated to helping Colorado accident victims get the compensation they deserve.

Learn more about our team