Table of Contents

You did everything right. You saw the snow squall moving in over the Front Range and decided not to drive. You tapped an app—Uber, Lyft, whatever—and put your safety in the hands of a professional.

Then came the jolt. The sickening crunch of metal on black ice.

One minute you’re in the back seat, heading to DIA or just crossing town. The next, you’re in a ditch off I-70, dazed and hurt. You’re a passenger in a rideshare wreck during a classic Denver winter storm, and the real blizzard—the one involving insurance companies—is just beginning.

This isn’t a normal car accident. The key to your entire case—the only thing that truly matters—is your driver’s status in the app at the exact moment of impact. That status is the switch that flips on a $1,000,000 commercial insurance policy. My entire job is to prove that switch was flipped, lock in the coverage you deserve, and dismantle the insurance company’s predictable, cynical attempts to leave you out in the cold.

The Trick Insurance Companies Don’t Want You to Know

After a rideshare crash in a Denver snowstorm, the real fight isn't about what happened on the slick road—it's about what was happening on the driver's phone.

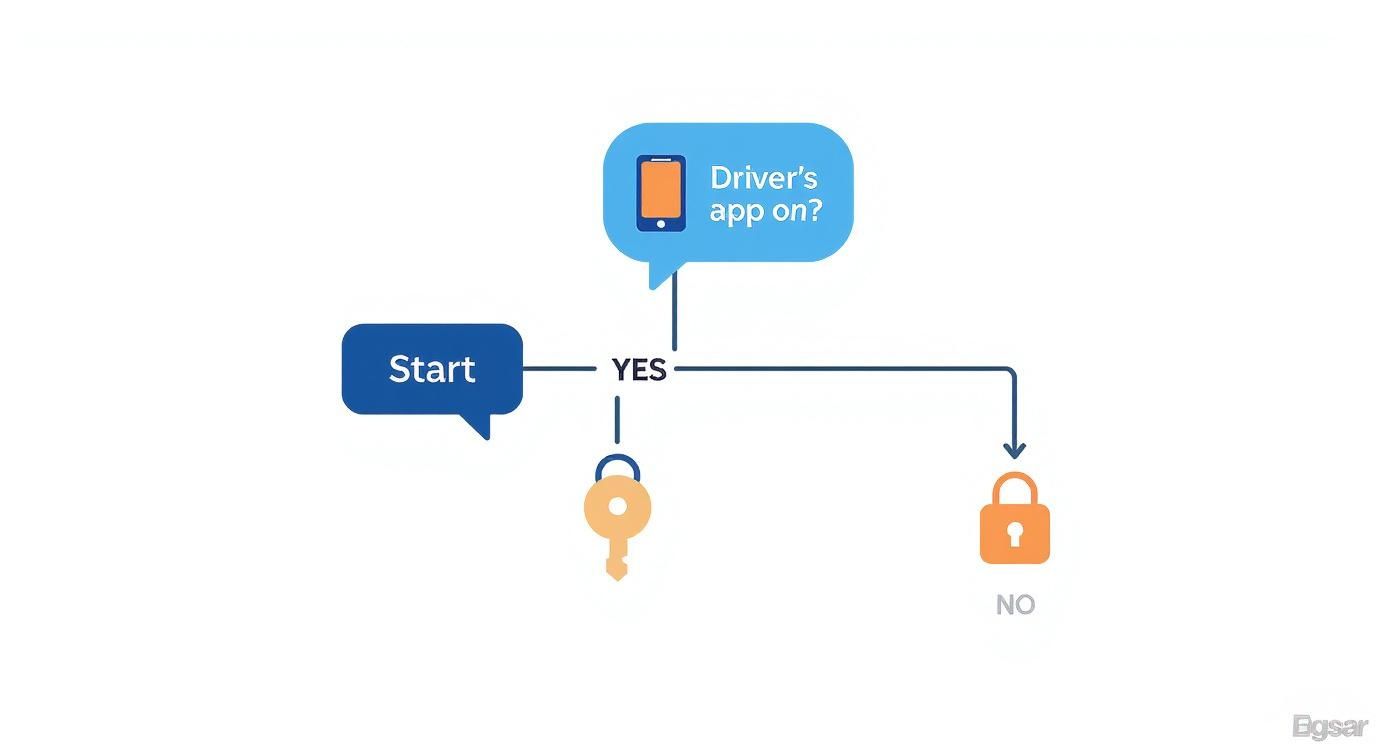

Everything—and I mean everything—hinges on which insurance policy applies. Colorado law (C.R.S. § 40-10.1-602, for the nerds) creates a three-tiered system. Your driver's status determines whether you have access to a tiny personal policy or the full $1,000,000 commercial liability policy.

Guess which one Uber’s/Lyft’s insurers would rather not pay out?

The Colorado Insurance Triad: Status is Everything

Their entire strategy is to push your claim down the insurance ladder to a lower, cheaper tier. They will exploit any ambiguity to save themselves a fortune at your expense.

- Tier 1 (App Off): The driver’s personal policy applies. This will almost certainly be denied because of a “commercial use exclusion.” It’s a dead end.

- Tier 2 (App On, Waiting for a Ride): Limited liability coverage kicks in—typically a paltry $50,000 per person/$100,000 per accident.

- Tier 3 (Ride Accepted or In Progress): The Full Commercial Policy. This is the $1,000,000 liability coverage you are entitled to as a passenger.

This is why their first move is to try to push the claim down to the driver's smaller personal policy. It's a purely financial decision.

The single most important action you can take after a crash—once you are safe—is to take a screenshot of your active ride in the Uber or Lyft app. That screenshot is digital gold. It is time-stamped, geo-located proof that you were in a Tier 3 ride, period. With it, you’ve just handed your lawyer the keys to the kingdom.

How We Prove Black Ice Negligence in a Winter Storm

Insurance adjusters love a good snowstorm. They’ll call it an “Act of God”—a convenient, almost biblical way to suggest no one is to blame.

Frankly, it’s nonsense. And it’s not the law.

A commercial driver has a heightened duty of care. They are professionals, and the law expects more from them than from the average commuter just trying to get home. Driving too fast for icy conditions on a commercial trip isn’t an “oops”—it’s clear negligence.

We don’t let them hide behind the weather. Instead, we use the storm as the backdrop to prove the driver failed to meet their professional obligations.

- Did they have adequate snow tires for the Front Range, or were they running on bald all-seasons?

- Were they driving too fast for the conditions, even if it was under the speed limit?

- Should they have even been on the road at all, or was accepting a high-risk fare to DIA during a blizzard a negligent choice?

My job is to dismantle the “Act of God” defense with cold, hard facts. We pull meteorological reports, subpoena vehicle maintenance logs, and analyze traffic data to prove the crash was foreseeable and preventable. The storm is merely the setting—the cause was a professional who failed to act like one. You can see more on how we handle these specific situations by checking out our guide for finding the right icy road car accident attorney in Colorado.

Who Pays For Your Injuries? It’s Simpler Than They Want You to Believe.

Let’s get one thing straight, because it’s the only part of this mess that’s simple—as the passenger, you are almost never at fault. You are well-covered. The only question is whose insurance company is going to pay.

My job is to see their cynical playbook coming and cut it off at the pass.

Scenario A: Your Rideshare Driver Is at Fault

If your Uber or Lyft driver caused the wreck—they lost control on the ice, drove too fast, whatever—the path is clear. We go directly after the rideshare company's $1,000,000 commercial liability policy.

This is exactly why that massive policy exists: to protect innocent passengers and other drivers from their drivers’ mistakes.

Of course, their insurer will fight it. But with proof of your active ride status and evidence of the driver's negligence, we force them to the table. We don't ask—we demand.

Scenario B: Another Driver Is at Fault

What if a third party is to blame? Say, another driver slides through a red light and T-bones your Lyft. Our primary target becomes that driver’s insurance policy.

But what if they only have Colorado’s minimum $25,000 policy, or worse, no insurance at all? We pivot.

We immediately turn back to the rideshare company and file a claim against their substantial Uninsured/Underinsured Motorist (UM/UIM) coverage. This is a critical layer of protection built into their commercial policy for this exact situation. It covers your injuries when the person who hit you can’t.

You are covered from multiple angles. The system is designed to protect you. My entire job is to cut through the red tape to enforce that protection. These complex rideshare statistics show just how vital these multiple avenues for a claim are.

Your First Moves to Secure Your Claim

The first few minutes after a crash are a blur. A few simple moves right now can make all the difference. Your first priority is safety—call 911 immediately. Get police and paramedics on the scene.

Then, become your own best advocate.

- Screenshot Your Active Ride. I can’t say it enough. Open the Uber/Lyft app and grab a screenshot showing the active trip. This is your golden ticket.

- Call the Police. An official police report is non-negotiable. It creates an official record of the event.

- Seek Medical Attention. Go to an ER or urgent care, even if you feel fine. Adrenaline masks injuries. A medical record from the day of the crash is undeniable proof.

Now for the most important warning I can give you: DO NOT give a recorded statement to any insurance adjuster. Not Uber's, not Lyft's, not the other driver's. None of them.

Their first move is always to try to push the claim down to the driver's smaller personal policy. That’s why these calls are not designed to help you—they are carefully planned interrogations meant to trap you.

Politely decline and tell them your attorney will be in touch. That's it. End the conversation. Understanding the complex world of navigating insurance claims and disputes is key, but it's my job to handle that, not yours. For a more complete checklist, our firm has a detailed guide on what to do after a car accident.

Disclaimer: The information provided in this article is for general informational purposes only and does not constitute legal advice. The content is not intended to create, and receipt of it does not constitute, an attorney-client relationship. You should not act or refrain from acting based on this information without seeking professional legal counsel. The outcome of any legal matter depends on a variety of factors, including the specific factual and legal circumstances, and past results do not guarantee a similar outcome in future cases. Conduit Law is a law firm licensed to practice in Colorado.

You’ve been through enough. Let me handle the insurance fight so you can focus on getting better. I’ve got you.

Written by

Conduit Law

Personal injury attorney at Conduit Law, dedicated to helping Colorado accident victims get the compensation they deserve.

Learn more about our team