Table of Contents

A car accident settlement isn’t lottery winnings. It's not a windfall. It’s simple repayment—the money an insurance company owes you for everything you lost when their driver wasn't paying attention. It's a negotiated agreement to cover your medical bills, lost income, and the physical/emotional toll of someone else's carelessness.

The goal isn't to get rich—it's to get your life back.

But let’s be brutally honest. That’s not how the other side sees it.

To the insurance company, you are a line item—a financial exposure to be managed. A problem to be minimized. And they have a playbook, refined over decades, to pay you as little as possible. This guide is here to tear that playbook apart and show you how to fight back for the car accident settlement you deserve.

This is about more than a crumpled bumper. It's for the searing pain from a herniated disc that makes it impossible to pick up your child. For the wave of anxiety that hits every time you have to get behind the wheel. For the lost wages from missing weeks—or months—of work.

The insurance company’s only goal is to protect their profits—not you. My goal is to arm you with the unvarnished truth. This isn’t just business. It’s about reclaiming what was taken from you.

The Cold, Hard Math Insurers Use to Diminish Your Pain

Think of your car accident settlement claim as two distinct piles of money. One pile is simple math—receipts and invoices. Insurance companies love this part. They call it economic damages.

This is the black-and-white stuff: every hospital bill, every lost paycheck, every copay for physical therapy. These are the tangible, verifiable costs you’ve paid because someone else was negligent. It's the easy part.

The real story of your crash isn't found on a receipt, though. It’s in everything that was taken from your life.

This is where non-economic damages come in—and where the real fight begins. This is about what you’ve been through. The chronic back pain that torpedoes a good night's sleep, the panic that rises when you see tail lights flash, the simple frustration of not being able to live your life without wincing.

Insurance companies have a cold, robotic way of dealing with your very human experience. They plug your medical bills into software—like the infamous Colossus—and use a secret formula to spit out a number for your suffering. They apply a "multiplier," usually between 1.5 and 5, to your medical bills to determine what your pain is worth.

They will never show you their math. They will never tell you what multiplier they used or why. Their entire process is designed to justify the lowest possible offer and dare you to prove you deserve more.

Your Damages Are More Than Just Medical Bills

Let's break down the two main categories of compensation you can claim. Understanding this difference is the first step toward fighting for your case's actual value—not just the value an adjuster assigns to it.

| Damage Category | What It Covers | How It's Valued |

|---|---|---|

| Economic Damages | Medical Bills (past & future), Lost Wages, Lost Earning Capacity, Property Damage | Receipts, Invoices, Pay Stubs, Expert Projections |

| Non-Economic Damages | Pain and Suffering, Emotional Distress, Loss of Enjoyment of Life, Disfigurement | Multiplier Method, Per Diem Method, Legal Precedent |

Knowing what you’re entitled to is critical. The national average car accident settlement hovers around $20,000, but that number is heavily skewed. A more realistic median is closer to $12,281. In states like California, the average bodily injury claim was already $51,635 by 2021. "Average" doesn't mean much—your case is all that matters.

The multiplier is where the adjuster has all the power—and where your attorney can fight back. A minor whiplash case might get a 1.5x multiplier. A serious injury requiring surgery? That should command a 5x multiplier, or even higher.

The problem is, the adjuster's first offer will always be based on an offensively low multiplier. They are betting you don't know how to prove the true, human cost of the accident. Check out our guide on how to calculate pain and suffering damages for a deeper dive.

The Playbook Insurance Companies Use to Deny and Devalue You

Insurance companies don't see you as a person. To them, you're a claim number—a liability on a spreadsheet. They have a well-worn playbook designed to make that liability disappear for as little money as possible.

They aren't your friend. They aren't on your side. They are a multi-billion dollar corporation, and every tactic they deploy is designed to frustrate, confuse, and wear you down until you accept a fraction of what your claim is really worth.

Your fight for a fair car accident settlement begins the moment you understand their cynical game.

Their First Move Is a Trap—The Quick Lowball Offer

One of their favorite moves is the quick-and-dirty settlement offer. An adjuster will call you, sometimes days after the crash, sounding impossibly sympathetic. They’ll offer a few thousand dollars on the spot—no hassle, just sign here.

This isn’t generosity. It’s a trap. They know you're stressed, out of work, and watching medical bills pile up. They prey on that desperation, hoping you’ll take the bait before you even know the full extent of your injuries. Accepting that offer means signing away your right to any future compensation. Forever.

They want you to settle before your doctor orders an MRI—before you realize that "sore neck" is actually two herniated discs that will require years of pain management. They are buying your claim for pennies on the dollar before you understand its real value.

Their Second Move Is a Lie—The Recorded Statement

You will be asked to give a recorded statement. Do not do it. The adjuster will say it's "just a routine part of the process." This is a calculated lie.

The only purpose of this recording is to get you on the record saying something—anything—they can later use to deny your claim. A simple, polite "I'm okay" in response to "How are you?" becomes Exhibit A in their argument that you weren't really hurt. It’s a cynical tactic that weaponizes your own decency against you. You can learn more about why insurance companies deny claims in our detailed guide.

Their Ultimate Weapon Is Silence—The Strategic Delay

Of all the shady tactics, this is the one that breaks the most people. Insurance companies have mastered the art of the strategic delay. They'll "lose" your paperwork. They'll shuffle your claim between adjusters. They will simply ghost you for weeks.

This isn’t incompetence—it’s a deliberate strategy. They know that every day you go without a settlement, the financial pressure on you intensifies. They drag things out for months, sometimes years, hoping you'll get so desperate that when they finally reappear with that same lowball offer, you’ll be too exhausted to keep fighting.

Delaying the process is their most effective weapon. It is a war of attrition. They have nearly infinite resources. You don't.

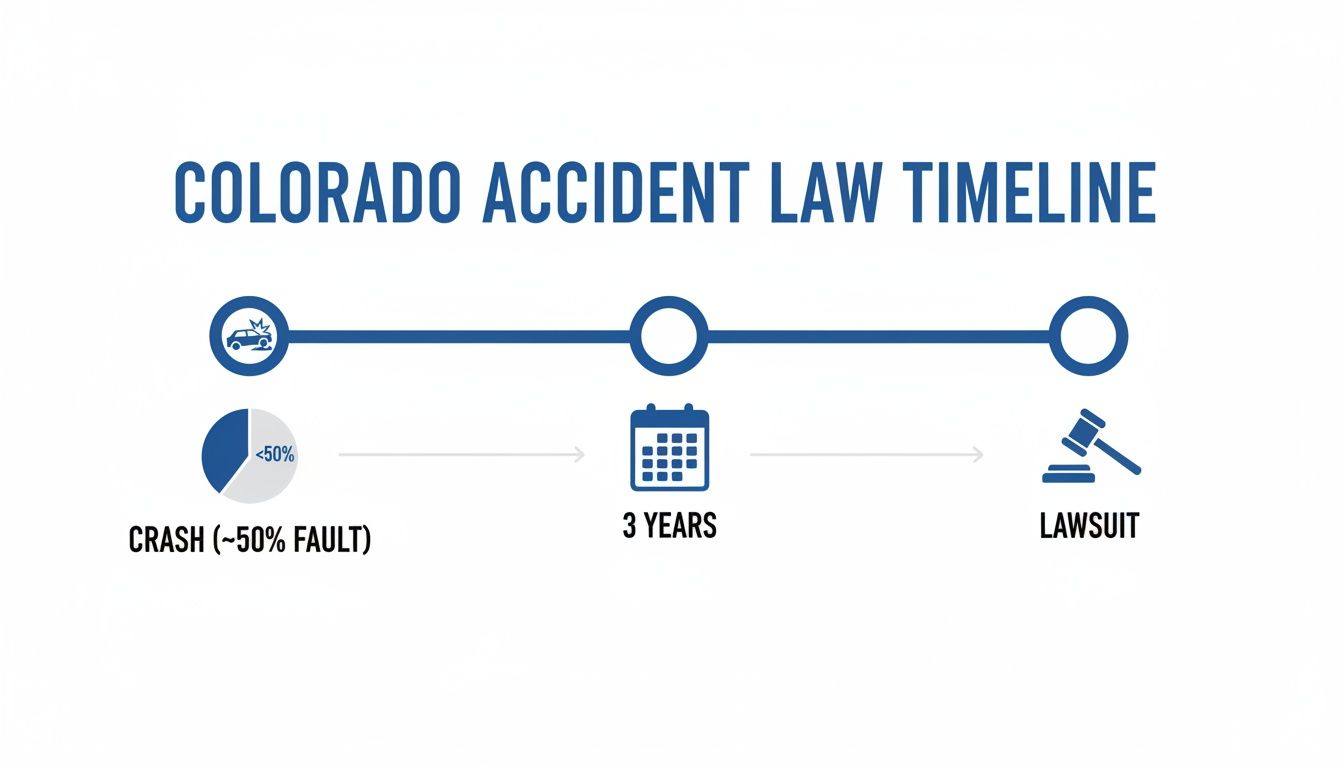

The Colorado-Specific Rules That Can Wreck Your Case

Every state plays by different rules. Thinking Colorado's laws are the same as California's or Texas's is a classic, costly mistake. These aren't just details in the fine print—they're the fundamental principles that will make or break your car accident settlement.

You can bet the insurance adjuster knows these rules by heart. And they will absolutely use every single one against you if you give them an opening.

Let's break down the two Colorado laws that will have the biggest impact on your fight for a fair recovery.

The Treachery of Modified Comparative Fault

This is the big one. It’s a legal doctrine called Modified Comparative Fault. You have to understand how it works. Imagine your total settlement value is a pie.

Under this rule, a jury—or the insurance adjuster—assigns a percentage of fault to everyone involved. If they decide you were 10% to blame—maybe you were going a couple of miles over the speed limit—your slice of the pie gets 10% smaller. You only recover 90% of your damages.

But here’s the treacherous part: Colorado has a 50% bar.

If you are found to be 50% or more at fault, you are legally barred from recovering a single penny. Your pie doesn't just shrink—it vanishes. You get nothing. Insurance companies love this rule. Their entire goal is to nudge you toward that 50% line so they can slam the door on your claim.

The Clock Is Always Ticking—The Statute of Limitations

The second critical rule is the statute of limitations. Think of it as a strict, non-negotiable deadline for filing a lawsuit. In Colorado, you have three years from the date of the crash for most car accident claims.

Three years sounds like a long time—but it disappears fast. Insurance companies know this perfectly well. Their strategy of endless delays is a deliberate attempt to run out the clock on you. Delaying the process is their most effective weapon.

Miss that deadline by even one day, and your right to seek compensation is gone. Forever. It doesn't matter how badly you were hurt. The courthouse doors will be legally barred to you.

Your Settlement Timeline—Mapping the Road from Crash to Check

Patience is a virtue, they say. But it’s easier to be patient when you know what to expect. A car accident settlement doesn’t just fall out of the sky—it follows a predictable, though often frustratingly slow, path.

Phase 1: The Foundation (Weeks 1-4)

This phase is all about investigation. We get the police report, track down witnesses, take photos, and put the at-fault driver’s insurance company on formal notice that you’ve been hurt. We are building the entire foundation of your case right here.

Phase 2: Healing and Documentation (Months 1-?)

This is the most important phase—and it cannot be rushed. Your only job here is to focus on your medical treatment and recovery. Go to every doctor's appointment, follow your treatment plan, and be honest about what you’re going through.

While you heal, we are meticulously collecting every single medical record and bill. This mountain of paperwork becomes the hard proof of your damages. Settling before you reach Maximum Medical Improvement (MMI)—the point where your condition has stabilized—is a catastrophic error.

An adjuster who pushes you to settle while you're still treating is not trying to help you. They are trying to close your claim before the true cost becomes clear. It's a calculated, predatory move.

Phase 3: The Demand and The Dance (Months of Negotiation)

Once your treatment is complete, we draft and send a formal demand letter to the insurer. This isn’t a simple letter—it’s a comprehensive legal argument, backed by all your records and our calculation of your total damages.

Then, the dance begins.

The insurer will respond with a lowball offer. This kicks off a period of back-and-forth negotiation that can take months. Simpler cases might resolve in 6-12 months for $8,200-$30,000. About two-thirds of cases settle before trial for an average of around $52,900.

If the insurance company refuses to be reasonable, the final step is filing a lawsuit. This doesn't mean you’ll go to trial, but it signals we are not backing down. Patience, backed by solid preparation, is your greatest asset.

Your Greatest Weapon Is An Attorney Who Costs You Nothing Upfront

How are you supposed to afford a lawyer when you’re already out of work and drowning in medical debt? It’s a fair question—and the answer is the great equalizer of the legal system.

It’s called the contingency fee model. It levels the playing field between you and a multi-billion-dollar insurance corporation. It’s simple—we don’t get paid a single dime unless you get paid. Our fee is a percentage of the final car accident settlement we win for you. Period.

This isn’t just a payment plan—it’s a partnership. Our incentives are perfectly aligned with yours. The bigger the recovery we secure for you, the better we both do.

The Real Value of an Ally in Your Corner

An experienced attorney almost always adds far more value to your case than their fee. We protect you from the traps insurers set. We know their playbook—the recorded statements, the lowball offers, the endless delays—and we know how to shut them down.

Firms like Conduit Law excel at negotiating the non-economic damage multipliers—often getting 2-3 times your medical bills for pain and suffering. This can turn a $10,000 medical expense into a $30,000+ settlement, all without any upfront fees. We’ve seen it: a teacher rear-ended with herniated discs recovered $175,000 after having $50,000 in bills—a 3.5x multiplier that took 11 months.

An attorney isn't an expense you can't afford. In this world, an attorney is the single best investment you can make in your own financial recovery.

The Hidden Financial Battles We Fight for You

Beyond the main settlement, we also handle the complex financial battles behind the scenes. This includes dealing with medical liens and subrogation claims.

- Medical Liens: If your health insurance paid for your treatment, they have a legal right to get paid back out of your settlement. We negotiate those liens down to put more of the settlement money in your pocket.

- Subrogation: Same concept, but with your own car insurance company if they paid for things like MedPay coverage. Again, we step in to reduce their claim.

These are complicated negotiations that insurers count on you not understanding. We handle it all, ensuring every dollar is maximized in your favor. Learn more about how a personal injury lawyer in Colorado can help on a contingency fee basis in our article.

Your Questions, Answered—No Legal Jargon Allowed

You've got questions. After a crash, your world is chaotic, and the insurance adjuster isn't going to give you straight answers. Let's cut through the noise.

How Much Is My Car Accident Claim Actually Worth?

There's no magic formula. The true value is a direct reflection of your specific losses. It's your economic damages (bills, lost paychecks) plus your non-economic damages (the real, human cost of your pain and suffering).

While every case is unique, minor to moderate injuries often settle for $2,500 to $25,000. Whiplash cases typically average between $8,000 and $24,000, depending heavily on your medical care and recovery time.

How Long Will This Whole Thing Take?

Patience is your most powerful asset. A straightforward case might wrap up in a few months, but complex claims often take over a year.

The clock is driven by:

- The Severity of Your Injuries: You should never settle until you've reached "maximum medical improvement."

- Disputes Over Fault: If the other driver denies responsibility, it takes time to prove what happened.

- The Insurer's Willingness to Negotiate: Some companies will drag their feet, hoping you'll get frustrated and take a lowball offer.

Should I Take the Insurance Company’s First Offer?

Almost never. Let me be clear: that first offer is a business tactic. It’s a lowball number designed to see if you’ll go away cheaply.

That initial offer is a trap. It almost never reflects the true value of your claim, especially before your future medical needs are fully understood. Accepting it means you sign away your rights to any future compensation. Just say no.

Can I Still Get a Settlement if I Was Partly at Fault?

Yes, absolutely. Colorado operates under a modified comparative fault rule. You can recover damages as long as you were less than 50% responsible for the crash. Your final settlement award is simply reduced by your percentage of fault. It’s that simple.

Disclaimer: This blog post is for informational purposes only and does not constitute legal advice. The information provided herein is not intended to create, and receipt of it does not constitute, an attorney-client relationship. You should consult with an attorney for advice regarding your individual situation.

This is a lot, I know. The system is designed to be overwhelming. You don’t have to do this alone. If you want to talk about what happened, the consultation is always free. I’m here. I got you.

Written by

Conduit Law

Personal injury attorney at Conduit Law, dedicated to helping Colorado accident victims get the compensation they deserve.

Learn more about our team