Table of Contents

A distracted driver in Denver blasts through a red light. In a single, sickening crunch of metal, your world flips upside down. Your mind is a messy collage of doctor visits, tow trucks, and the gnawing anxiety of what comes next. The absolute last thing on your radar is some dusty legal deadline.

Which, of course, is exactly what the insurance companies are betting on.

They know the Colorado personal injury statute of limitations isn’t some polite suggestion—it’s a guillotine. It’s a hard deadline, a ticking clock that can—and will—erase your right to compensation forever if you let it run out. They are practically salivating at the thought.

Let me be brutally clear: this isn’t about just filing paperwork. It’s about protecting your future. If you miss that filing window, your claim—no matter how righteous, how catastrophic, how valuable—simply evaporates. Gone. Let's make damned sure that doesn't happen to you.

The Clock Ticks Differently for Different Disasters

In the cold eyes of Colorado law, not all injuries are created equal—and neither are their deadlines. Your timeline depends entirely on how you were hurt. The legal clock for a multi-car pileup on I-25 ticks very differently than for a slip-and-fall at a sloppy King Soopers.

- Car/Truck/Motorcycle Accidents: You get a three-year window. This is a practical nod to the sheer chaos of traffic collisions—a chaos that saw a staggering 112,345 crashes on Colorado roads in a single recent year.

- General Negligence (Slips, Dog Bites, etc.): For most other injury claims—like a fall on an icy sidewalk or an injury from unsafe property—the clock is a much shorter two years.

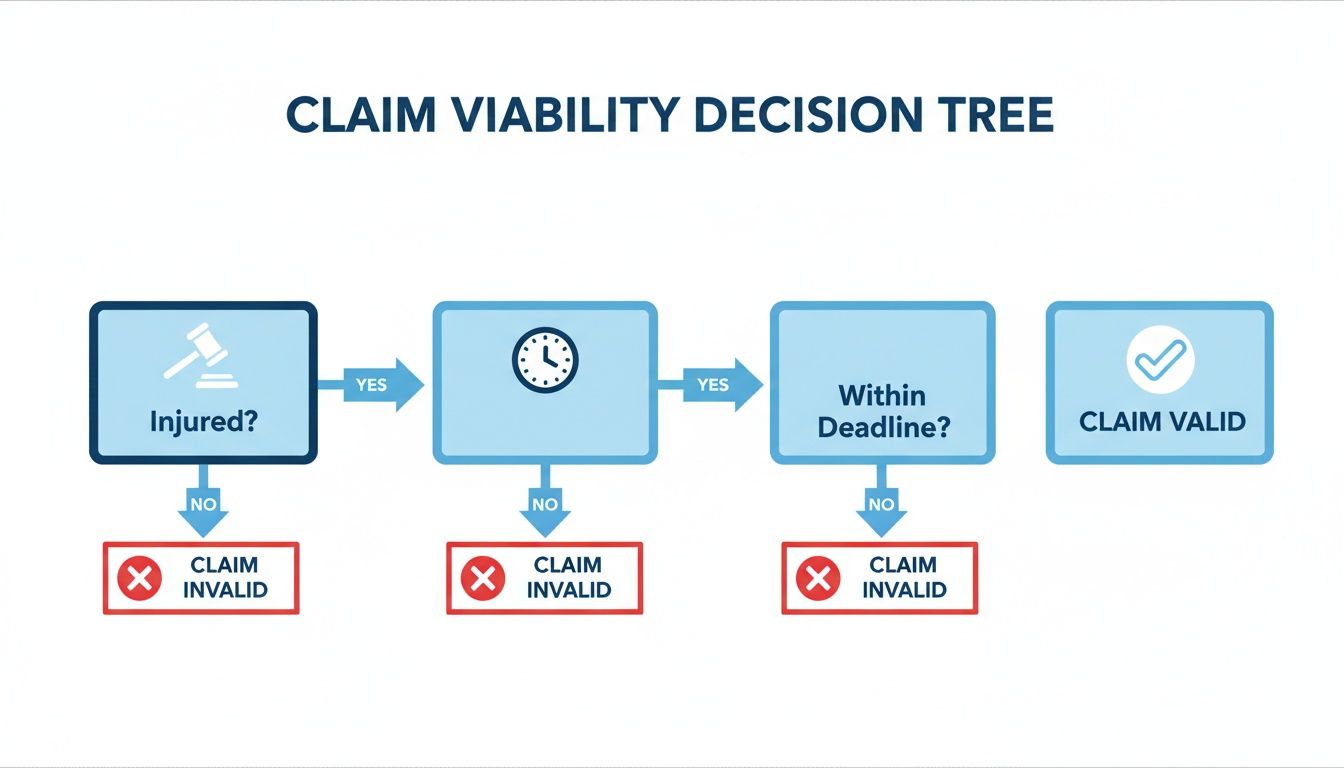

This flowchart breaks down the basic path to figuring out if your claim is even viable.

It all boils down to one brutal question: did you act before the deadline vaporized your rights? Dive deeper into these timelines with our full guide to Colorado's statute of limitations.

The Insurance Company’s Favorite Trick: Weaponizing the Calendar

Let’s get one thing straight—the insurance adjuster assigned to your claim is not your friend. They are not your neighbor. Their one and only job is to protect their company's profits, and their favorite tool for doing that is the calendar.

They will deploy a cynical, predictable strategy known as "delay, deny, defend." It’s a disgusting game. They’ll pretend to cooperate, stringing you along with an endless river of paperwork requests and hollow promises. You'll hear phrases like, "We're just waiting on one more piece of information" or "We're still investigating."

This isn't bureaucratic incompetence—it's a calculated performance. It’s meticulously designed to lull you into a false sense of security while the Colorado personal injury statute of limitations quietly bleeds out in the background.

Don't fall for it. They will drag your claim out with fake promises until the statute of limitations expires, leaving you with absolutely nothing. The moment that deadline passes, your power vanishes—and they legally owe you zero. Understanding why insurance companies deny claims is your first line of defense.

The Sneaky Deadlines That Ambush Your Claim

The standard two- and three-year rules have exceptions—and frankly, some of them feel like legal landmines designed to blow up your case.

- Injuries by the Government: If a government entity hurt you—think a city bus, a poorly maintained public park, a state employee—you are facing a much shorter, more vicious deadline. The Colorado Governmental Immunity Act (CGIA) requires you file a formal ‘notice of claim’ within a mere 180 days. Miss that, and your right to sue is gone. Period.

- Defective Products: Claims for injuries caused by faulty products also get a two-year rule, but it’s tied to the 'discovery rule.' The clock starts ticking only when you discover—or reasonably should have discovered—both the injury and that a defective product was the cause.

- Wrongful Death: These heartbreaking cases have their own complex timelines. You can see how the Colorado wrongful death statute of limitations works in our detailed guide.

These exceptions are procedural trapdoors. Don’t get caught in one.

The Rare Times You Can Legally Pause the Clock

While the Colorado personal injury statute of limitations feels ruthlessly final, the law isn’t completely heartless. It recognizes a few situations where it would be profoundly unfair to let the clock run out before you have a real shot at filing.

This is where two critical legal concepts come in: tolling and the discovery rule.

Tolling: The Legal Pause Button

Think of tolling as literally hitting pause on the deadline. The clock legally stops running for a period of time. This usually applies when the injured person can't legally act for themselves.

- Minors: If the victim is a child, the clock typically doesn’t start ticking until they turn 18.

- Mental Incapacity: If an injury leaves you so impaired you can't manage your own affairs, the deadline can be tolled until that disability is lifted.

The Discovery Rule: When the Clock Starts Late

The discovery rule is different. It doesn't pause the clock—it changes when the clock starts. This rule is a lifeline when you couldn't have reasonably known you were injured until much later.

Imagine a surgeon leaves a sponge inside you. You might not feel anything for months, even years. In that case, the statute of limitations doesn't start on the day of the surgery. It starts on the day you discover (or reasonably should have discovered) the sponge and the harm it caused.

These exceptions are narrow and fiercely debated by insurance lawyers, but they are crucial for ensuring justice isn't denied simply because an injury took time to reveal itself.

Don’t Just Meet the Deadline—Beat It By a Mile

That statute of limitations isn't a goal. It’s the final buzzer sounding on a game you’ve already lost. Treating that date like a finish line is a catastrophic error that hands all the power—and all your money—to the insurance company.

A powerful case is built in the days and weeks after an accident—not months or years later when evidence has vanished and memories have faded. Waiting until the last minute just screams desperation. It signals to the adjuster that your options are gone, inviting a garbage-level offer they know you'll be forced to consider.

They will drag your claim out with fake promises until the statute of limitations expires, leaving you with absolutely nothing. This isn't just business; it's a predatory tactic.

The key isn't just filing on time. It's acting with urgency. It's understanding the Colorado personal injury claim process and building a case so strong they’re terrified to take it to trial. While you can try to master effective legal research techniques, your first and best move is always to arm yourself with an expert.

Straight Answers to Your Colorado Injury Deadline Questions

Let’s cut the crap. You’re hurt, you’re stressed, and you need clear answers. Here are the no-nonsense responses to the questions we get asked most about Colorado's injury deadlines.

- Does settling with an insurance company affect the statute of limitations? Yes—once you accept a final settlement, you waive your right to sue, so the deadline becomes irrelevant. That's why you never accept an early, lowball offer.

- What if I didn't realize how severe my injuries were at first? This is where the discovery rule might come into play, but it’s a very high bar. The clock generally starts when you knew—or should have known—you were hurt, not when you knew the full extent of the damage.

- Can the insurance company extend the deadline for me? No. Never. Don’t even entertain the thought. Only a court can toll the statute of limitations, and an adjuster's empty promise means nothing. It's a trap.

Disclaimer: This blog post is for informational purposes only and does not constitute legal advice. The law is complex and every case is unique. You should consult with a qualified attorney to discuss the specifics of your situation.

Call me. Let's talk it through.

You have questions. I have answers. Your consultation is always free. Give me a call at (720) 432-7032, and let's figure out the next step together. No pressure, no nonsense—just a real conversation about how to protect your rights.

Written by

Conduit Law

Personal injury attorney at Conduit Law, dedicated to helping Colorado accident victims get the compensation they deserve.

Learn more about our team